The Hedging Corner: Crude oil drives resin prices -- more evidence

As discussed in last week's Hedging Corner, price transparency and price fairness are concerns among plastics processors and anyone else who buys plastics. How do you know the over-the-counter (OTC) offer is fair and reasonable if you don't have an unbiased price gauge to compare it to like buyers of other commodities?

May 10, 2011

As discussed in last week's Hedging Corner, price transparency and price fairness are concerns among plastics processors and anyone else who buys plastics. How do you know the over-the-counter (OTC) offer is fair and reasonable if you don't have an unbiased price gauge to compare it to like buyers of other commodities?

If the market history of other commodities (particularly energy) holds true in resins, then resins futures are likely to become the price "barometer" -- but what about now? If you're not sure about a physical OTC price, you will be unsure about the price of a direct resins hedge. In addition, since hedges are, fair or not, subject to more scrutiny and second-guessing than physical transactions (even among companies with risk management experience), so what's a new resins hedger to do?

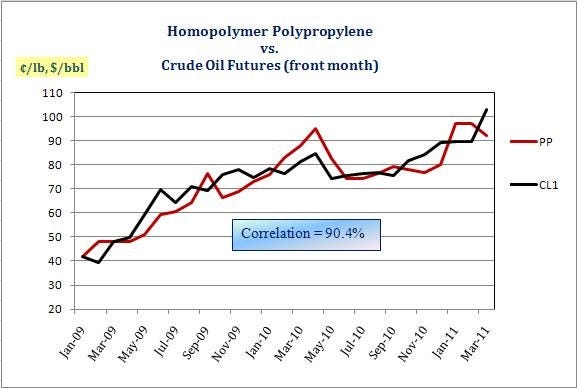

As shown last week, the correlation between daily resins prices recorded by PCW and crude oil futures is surprisingly high. How about over less frequent pricing periods, which are more reflective of resins pricing? Does the high correlation still hold? Apparently so, as this chart for polypropylene prices vs. crude oil indicates.

|

(Chart: CMAI)

For traders and hedgers, it doesn't get much better than the crude oil market for price liquidity, transparency, fairness, and - very important for hedging purposes - the range of transaction choices available through exchange traded funds and options at enough strike prices to satisfy the most cautious and capital-constrained hedger. So plastics processors who have avoided direct hedges in resins due to real and perceived limitations in resins pricing have more and better hedging choices available than they likely thought they did.

High and volatile crude oil prices are responsible for roughly 90% of the increase and volatility in resins prices. Passing plastics price increases along to customers is difficult -- for competitive and strategic reasons. As a result, margins have suffered.

Weak margins threaten companies' viability and employees' futures, but they are not a risk processors must continue to take. It's time for processors to go on offense against crude oil prices. Hunkering down and hoping resins prices will fall or that your company can outlast the competition is a "strategy" that leads to underperformance or even failure. With crude oil (and, possibly, natural gas) alone or in combination with direct resins hedges, processors have many hedging strategies available to them. We'll discuss some of those strategies, and the means and structure for implementing them, in upcoming articles.

About the author: Tom Langan is a risk management and trading consultant who operates WTL Trading. He specializes in commodity cost control, loves to trade options, and enjoys teaching others ways to protect and increase the value of their manufacturing and personal portfolios. He has worked with private and public entities, as well as individuals, in helping control and take advantage of volatile oil and gas, electricity, resins, and metals prices. More background information here.

About the Author(s)

You May Also Like