IMM's Plant Tour: Industry icon forges ahead

A family-owned marvel evolves its often-imitated business model and proves it can thrive in today’s challenging environment. Is imitation the sincerest form of flattery? Hoffer Plastics is in a good position to answer this question. Its business model has been studied and copied more than a few times by other molders who saw it as an ingenious means to efficient operations.

October 29, 2008

A family-owned marvel evolves its often-imitated business model and proves it can thrive in today’s challenging environment.

Is imitation the sincerest form of flattery? Hoffer Plastics is in a good position to answer this question. Its business model has been studied and copied more than a few times by other molders who saw it as an ingenious means to efficient operations.

|

In case you’re unfamiliar with the paradigm, Hoffer operates a total of eight molding areas or “focused factories,” each under the direction of its own plant manager. Each plant is operated as a small company dedicated to providing customers with individualized attention. Together, the eight plants feature continuous climate control and ship roughly 3 billion parts per year with a 99.2% on-time-delivery and near-zero-ppm record. The plants are served by three toolrooms that employ 24 moldmakers.

The late founder, Bob Hoffer Sr., was the type of manager who walked the floor and knew everyone’s name because he valued all of his employees equally. He believed that there was a limit to the number of injection molding machines that could be operated efficiently by a single plant manager. After a bit of analysis, Hoffer settled on 12 presses, and further decided that these machines should all be dedicated to the same purpose—either to one customer or to a specific end-use market segment.

Today, Hoffer’s son Bill, granddaughters Gretchen Farb and Charlotte Chisholm, and grandson Alex Hoffer continue to add to the legacy he left without fundamentally changing the core strategy. Let’s take a look inside these plants-within-a-plant and see what makes them successful.

More than the sum of its parts

Managers start their day at 8 am with an 11-minute (no more, no less) meeting to focus on production and continuous improvement issues. Each plant manager has a solid idea of where his plant stands in terms of ppm rejects, percentage of cavities running, and scrap rates, thanks to a report card system. Plants compete against one another to increase their productivity, fostering a culture of continuous improvement.

One of the original tenets at Hoffer involved reusing or recycling everything, from scrap metal and cardboard to paper and plastic. A bit ahead of its time, Hoffer’s recycling program today is very much in evidence as we start the tour. Plastic scrap and corrugated packaging are lined up awaiting the recycler’s pickup.

At the first toolroom we visit, tooling engineers are at work building prototype molds, which can typically be created in two to three weeks. Engineers design tools via SolidWorks, perform analysis using Moldflow software, and program CNC machines using EdgeCAM. The resulting mold is a single-cavity prototype tool cut from P-20 steel and gated exactly like a production tool. Using moldfilling, cooling, and warpage analysis when building the prototype tool, Hoffer Plastics is able to translate the lessons learned into a Six Sigma process on the manufacturing floor.

Fifteen Van Dorn machines and one new high-speed Demag line the shop floor in Plant 1, ranging from 120-300 tons. Consumer and industrial applications are running here, including a 96-cavity mold built in 1980 that produces nylon actuators for aerosol valves. Acetal caps for a consumer detergent pen are also being produced in an automated cell. The caps are cooled by refrigerated air as they move from the conveyor to a box drop. As the boxes fill, a shuttle system moves an empty box forward and technicians collect the full box for shipping.

Plant 2, which is dedicated to automotive production and small engine components and assemblies, includes 13 presses. All Hoffer plants use Fourth Shift production planning software from Microsoft, along with an enterprise quality management package called MQ1 (Cebos). The software contains a daily schedule for every press in every plant for the upcoming 24 hours.

Presses in this plant are all Toshibas, 150-310 tons, selected for their reliability and accuracy. They’re equipped with Conair dryers and Star robotics.

In Plant 3, 10 Van Dorn machines ranging from 120-300 tons are accompanied by two Toshibas and two Demags in a rare mixing of machine manufacturers. Packaging is the focus here, with aerosol caps and food containers in profusion.

Inspector technicians perform quality checks every hour to ensure traceability, and automated box shuttle systems weigh and box parts without human intervention.

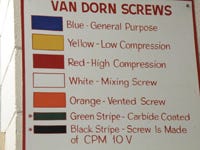

Plant 4 is currently undergoing renovation, but nearby, we spot about 100 rows of color-coded screws lined up in racks against the wall. This library of screws demonstrates another Hoffer core discipline. Its plants change screws with each unique material or color change, and this system, segregated by manufacturer and screw design, allows each plant to have inventory available when needed. Instead of the laborious hours usually spent chipping and cleaning a screw, all are cleaned automatically via a 900°F fluidized bed before being checked for wear and returned to their color-coded locations.

In Plant 5, we find 12 Toshibas ranging from 170-500 tons molding PP material piped to the presses from one of Hoffer’s eight silos. This is another packaging-intensive factory, and fully automated workcells are again the norm.

At Plant 6, a 610-ton Husky press fitted with a 64-cavity (32+32) stack mold is pumping out lids for juice containers. As the lids travel on a conveyor to be automatically boxed, refrigerated air maintains a 60°F environment for proper cooling.

Four new Demag machines support growth in the packaging business fulfilled by Plant 7. Here, assembly and secondary operations are brought close to the press to improve productivity.

Innovative automation in Plant 8, also dedicated to packaging, includes a vacuum tube that transfers caps from two molding lines to the other side of the plant wall. There, the caps are fed into an automated closing and lining system, which uses a vision system to ensure caps are lined properly at the rate of 17 per second. Volumes for the lined caps reach about 100 million annually.

Tools as race cars

What underlies all of this highly productive square footage and makes it sing? We believe after touring the plants that it is Hoffer’s singular focus on tool maintenance as a top priority. Remember that mold from 1980? It’s a testament to maintenance that all cavities on this 28-year-old tool are operational today. In fact, even the highest-cavitation mold at Hoffer (216) runs on all cylinders.

Brian Wagner, director of manufacturing, explains the philosophy with an analogy. “Molds are like race cars. If you want to win, they have to be fast and competitive. Our high-cavitation tools run at 94% or better, thanks to this attitude.”

Wagner recalls a mold transfer project involving 50 tools that were not up to Hoffer standards for preventive maintenance. “We received them on a Thursday before Easter and worked around the clock to disassemble, clean, and restore them. By Monday, we were shipping parts.”

In the mold PM area, tooling engineers track actual run hours and assign a target number of hours between maintenance procedures, depending on the complexity of the tool and the material characteristics. Based on operating observation, this may be adjusted. But in all cases, extreme dedication to the “race car” makes the rest of the plant hum.

Global future with Intec

In July, Hoffer Plastics announced a strategic alliance with The Intec Group (Palatine, IL), a primarily automotive molder with plants in Mexico, Singapore, and China. Both companies have been part of a benchmarking group for 15 years, according to Bill Hoffer, and discussions have been ongoing for the past three years. While the two companies will continue to operate independently and serve their own customers, Hoffer gains a global footprint and Intec gains a valued and trusted investor.

There are striking similarities between the two molders. Both companies are third-generation family owned and both Bill Hoffer and Intec president/CEO Steven Perlman are similarly focused on adding value for customers. Both were established in 1953, and both have headquarters in Illinois. In fact, they are within a 20-minute drive of one another. (Click here for an initial report.)

Under its own power

As a last note, this gigantic plant has gargantuan energy requirements, so being prepared for an emergency becomes critical. In 1992, Hoffer built its own electricity cogeneration (CoGen) plant within the facility. It consists of nine diesel locomotive engines converted to 800-kW power generators. The generators run on natural gas, which Hoffer buys on the open market.

Until 2006, it was cheaper to generate electricity for the plants this way, and the annual savings topped $1 million. But as the price of natural gas went up, the cost advantage disappeared. Hoffer still checks prices daily to see if it is cheaper to make or buy electricity, but the answer for the past couple of years has been to buy. Instead, the generators offer a backup.

To this end, the CoGen plant, like many modern-day golf courses, monitors lightning strikes and wind speed via an early detection system that puts the generators on standby so Hoffer Plastics doesn't miss a beat.

You can also find IMM’s 1999 interview with the late Robert A. Hoffer Sr. at imm.plasticstoday.com/?q=articles/9104.

Vital Stats: Hoffer Plastics Corp., South Elgin, IL

Facility size: 360,000 ft2 (total) includes 61,000-ft2 finished goods warehouse, 72,000-ft2 material warehouse, eight receiving docks, seven shipping docks, four multiuse docks, and eight raw material silos

Annual sales: Approximately $60 million (2007)

Markets served: Packaging, consumer/industrial, automotive, lawn/garden, medical, electrical/electronic, appliance

Capital investment: $2 million for new Demag machines in Plant 7 (2008)

Parts produced: 3 billion parts shipped per year

Materials processed: More than 400 commodity and engineering thermoplastic grades

No. of employees: 300-plus (average tenure 14 years)

Shifts: Three, seven days/week as required

Molding machines: 94 production, 50-610 tons; three sampling, 150-500 tons; Demag, Van Dorn, Toshiba, Husky

Molding technology: High-speed molding, high-cavitation tools (including stack molds), two-shot molding, gas-assisted molding, MuCell, automated workcells, inmold decorating, Class 100,000 cleanroom molding

Internal moldmaking: Yes, for prototype molds; 24 toolmakers and three toolrooms

Quality: ISO 9002/QS 9000, ISO/TS 16949:2002

Web extra: How Hoffer Plastics handles the resin market

Gretchen Hoffer Farb, director of supply chain management at Hoffer Plastics (South Elgin, IL), spoke with IMM about her company’s material needs and how this massive materials consumer remains competitive in the face of resin price increases.

IMM: What types of materials do you purchase, how do you place orders, in what quantities, and from whom?

Farb: We run 420 resins, from engineering thermoplastics to polyolefins, and purchase about 20 million lb per year. We also operate eight silos—two that can hold 60,000 lb and six that hold 90,000 lb. Exotic resins such as Ryton PPS and Ultem PEI are also part of the mix, as is gas-assist molding and MuCell. Our suppliers include DCO International, DuPont, BASF, and M. Holland, among others. Our inventory is controlled by our ERP system, and is integrated with the order system. Purchase orders are driven by the ERP system, so as orders for parts are entered, orders for material are sent out. The system will also combine orders for better pricing.

IMM: Have you considered offset materials to reduce costs?

Farb: I am a member of a benchmark committee composed of seven of our competitors in the Midwest. We meet two or three times a year, and focus on marketplace trends. We can’t discuss pricing, but can talk about the state of the market and share where we’ve been able to find offset materials. So yes, we are looking into this. Also, we can leverage resin producers by working with our supply base and our relationships. One of the unique features at Hoffer is that we employ a robust engineering group of six developmental engineers who can search for alternate materials. We also have an internal materials database that they use to search for offsets, and they may use the IDES Prospector system [www.ides.com] for material selection as well.

IMM: What other techniques do you use to reduce the cost of materials?

Farb: In addition to offset, we sometimes prebuy resins to offset future increases and to protect our customer as long as possible. If I can buy 90,000 lb today and avoid an $0.11 increase that goes through tomorrow, I have saved almost $10,000. We are also working with customers to cospecify materials at the start of a job, so that we have some leverage in negotiating pricing.

IMM: Hoffer has been committed to recycling since its inception. How is that program working today?

Farb: All proceeds from recycling our materials are now given back to employees via a variety of programs. Since this initiative was started a few years ago, we have sent only 0.01% of our material to a landfill. All the rest has been recycled. More than 400 materials, segregated and labeled, are recycled every year. All corrugated cardboard is baled and sent out to recyclers. Scrap metal is likewise sold to recyclers. As a result, our customers don’t pay for waste. We have a lean operation with low scrap rates, and together with the recycling program, we have the ability to remain competitive on price.

Contact information

Jack Shedd | (847) 717-5776

www.hofferplastics.com

About the Author(s)

You May Also Like