Plastics unplugged: India’s plastics industry copes with outages

The sheer numbers around the power outages that darkened India earlier this week—more than 600 million without electricity, grids collapsing in 14 states—placed the emerging country beneath a worldwide media spotlight.But for the Indian plastics industry, including both domestic and foreign firms, spotty power is a largely accepted reality in a country whose energy demand has consistently outstripped its production since economic reforms starting in 1991 pushed it unto the global economic stage.

August 2, 2012

The sheer numbers around the power outages that darkened India earlier this week—more than 600 million without electricity, grids collapsing in 14 states—placed the emerging country beneath a worldwide media spotlight.

But for the Indian plastics industry, including both domestic and foreign firms, spotty power is a largely accepted reality in a country whose energy demand has consistently outstripped its production since economic reforms starting in 1991 pushed it unto the global economic stage.

"Consistent availability of competitively priced power is crucial to the plastics industry," Jayesh Rambhia, president of the All India Plastic Manufacturers Association, told PlasticsToday, before stating plainly, "India has a deficit in power."

Jayesh Rambhia |

Jayesh Rambhia, president of the All India Plastic Manufacturers Association. |

Rambhia noted that power cuts across country are routine, varying from 1 to 2 days/week, or a few hours/day depending on location and seasonal demand. It's his view, however, that such cuts should not be the reality for industry.

"Industry should get preference in power supply," Rambhia said. "Industry should not be made to pay for power subsidies to agriculture or consumers." Rambhia told PlasticsToday that his own company is in Mumbai, where power is "costly but consistently available."

Power-hungry equipment as part of the problem

Rambhia said a possible partial solution to the power problem could be state incentives for companies like his to upgrade to new, more energy efficient equipment.

"India has a power deficit, but many of our machines are old and consume nearly 40% more power than modern machines," Rambhia said. "We have asked the central government to give a one-time tax holiday for upgrading of old machines with new energy-saving drives and controls. It would benefit environment, industry, and other consumers of power."

Anvita Sarkari, manager of sales promotion at Lohia Starlinger Ltd., a plastic woven fabric and flexible packaging machinery manufacturer located in New Delhi, told PlasticsToday that because of the consistent power supply issues most of the plastic processing companies augment their power supplies through in-house diesel-powered generators.

"The present outage in India, resulting from technical reasons, is restored to a large extent now," Sarkari said. "We do not believe that this would impact the medium- to long-term prospects of the industry."

For Sanjeev Yadav, general manager of quality and product development at biaxially oriented polypropylene (BOPP) film manufacturer Max India Ltd. Chandigarh, outages are a non-issue. Yadav said his plant, which is located in North India state of Punjab, gets direct power supply from Punjab Government into its own 132-KV power substation.

"Our power supply disrupts only if there is issue in main grid," Yadav said, "which happened once or twice in a decade."

India's enduring allure

While the global average for per capita consumption of plastics is 26 kg, with North America and Western Europe topping out at 90 and 65 kg, respectively, India's per capita consumption comes in at 5 kg, well below China (12), Southeast Asia (10), and Latin America (18), according to India's Central Institute of Plastics Engineering & Technology (CIPET).

With a population of 1.2 billion, the possibility that the average Indian could consume even a little more plastic has made the country a target for investment by western firms.

Auxiliary supplier Conair was among the western companies setting up shop in the country, establishing a 50/50 joint venture called Nu-Vu Conair Pvt. Ltd. in 2007. Headquartered in a 43,000-sq-ft (4000 sq m) facility in Ahmedabad, India, it is managed locally by Bhaumik V. Patel, K.M. Shah, Ajay Shah, and S.P. Kudva.

'Part of daily life'

In response to questions from PlasticsToday, the company said that since it's located in the western state of Gujarat, it was not affected by the outage, since the power-grid failures were limited to northern and eastern regions of India. The company said its suppliers were not impacted either, but that "many" Conair customers were affected, although power was restored within 8 to 15 hours.

"Power shortages are a part of daily life in India, and businesses operate accordingly," the company stated, noting that to limit demand, industrial power is shut off one day each week in the different states. "For Nu-Vu Conair, in Gujarat, that day is Thursday and so that day is a regularly scheduled day off," the company spokesperson explained.

Nu-Vu Conair also noted that to cope with unscheduled power outages, most mid-sized and large industrial companies have their own, captive diesel or gas generators.

Powering up for the future

The subtitle for India's Ministry of Power 2011-2012 Annual Report states the importance of power plainly: "Power: The building Block of the Economy." That year's report and previous editions show a country that has consistently invested in its power infrastructure but still consistently failed to match output with demand.

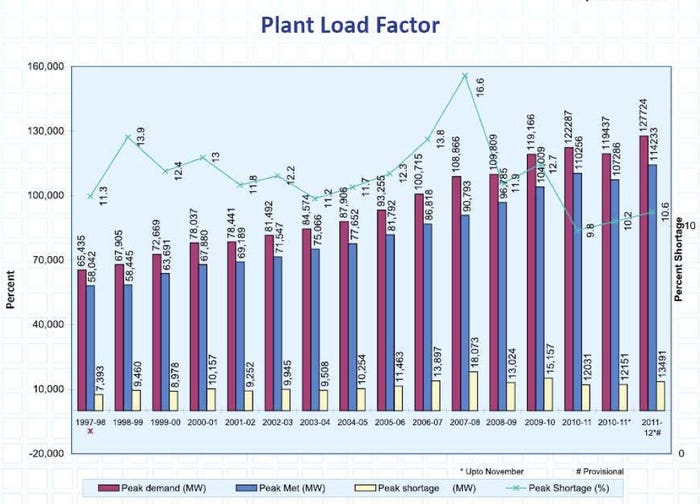

India's Plant Load

According data on "plant load factor", which is an index of installed capacity utilization, the overall utilization percentage has been in decline with the global economy since the onset of the worldwide economic crisis. Capacity utilization most recently peaked in 2007-2008 at 78.6%, but has since seen declines every year since, with 2011-2012 coming in at a projected rate of 71.6%.

As India took its place among emerging economic powers, total electricity generation did make huge strides, increasing from 260.4 billion units (BU) in 1990-1991; 420.6 BU in 1997-1998; and all the way to 811.1 BU in 2010-2011.

But despite more than tripling its generation over the last two decades, from 1997 through 2011, India still maintained an average energy shortage of 8.3%. That figure ranged from a low of 5.9% (energy requirement of 446,584 million units against an energy availability of 420,235) to a high of 11.1% (energy requirement of 777,039 million units against an energy availability of 691,038). In 2010-2011, the energy gap stood at 8.5%, despite the fact that since 2007, nearly 35,000 MW of capacity have been added to India's grid, with the most, 12,160.5 MW, brought online in 2010-2011.

In April, India's Minister of Power Shri Sushilkumar Shinde addressed the World Energy Leaders Summit in Istanbul, noting at the time that his country is the fifth largest energy consumer in the world, although its per capita primary energy consumption is only 580 kilograms of oil equivalent (kgoe). More than two-thirds less than the global average of 1800 kgoe.

In a way foreshadowing the recent massive outages, Shinde told the summit that energy requirements in India were expected to continue to grow in the coming years, projecting that India would leapfrog to the third largest energy consumer by 2020, trailing only the U.S. and China.

About the Author(s)

You May Also Like