6 Forces Shaping Plastics Recycling

Digital platform Circular.co reveals the headwinds, tailwinds, and drivers in the $600 billion plastics industry’s movement to circularity.

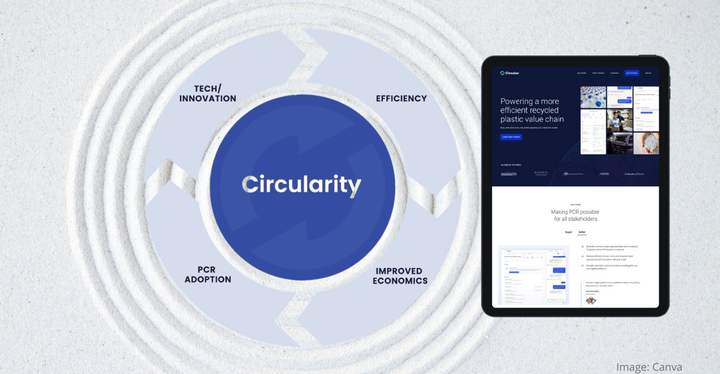

A new report from Circular.co offers a comprehensive view of the opportunities, obstacles, and drivers that the recycled plastic value chain faces as it strives to build a circular economy.

The report, Plastics Uncovered: Optimizing the Recycled Plastic Value Chain, addresses the recycled plastics industry’s complexity, including challenges to buyers, blocks to sustainability, recycling legislation, and the role of technology. It offers six key takeaways, described below.

1. The plastics industry is at an environmental crossroads.

The plastics market is currently worth almost $600 billion and is expected to grow to more than $800 billion by 2030, according to the report,

This large and expanding market needs to move from a linear to a circular economic model to achieve sustainable production and consumption of plastics — and to avoid dire environmental consequences.

It’s no secret that brands and manufacturers are making sustainability commitments for materials sourcing. Demand for sustainable commodities, including recycled plastics, “is only going to increase,” Ian Arthurs, founder and CEO of Circular.co, tells us.

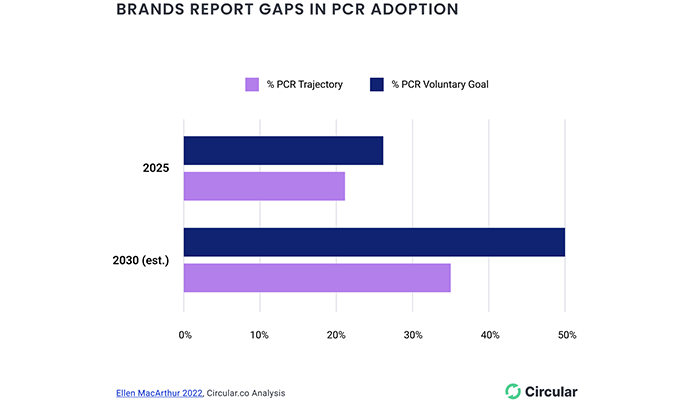

Yet, for now, companies are falling short on their aims to reduce their virgin plastics dependency and boost use of post-consumer recycled (PCR) plastics.

2. Sustainability offers economic opportunity.

Brands that make Environmental, Social, and Governance (ESG)-related claims grow faster than those that do not. A McKinsey report reveals that those making ESG claims experienced 28% cumulative growth over the past five years, on average, vs. 20% for those with no ESG claims.

Having reliable data about the carbon footprint of the PCR value chain vs. the virgin plastics value chain “would drastically help the buyers [and] the brands think about ESG claims on packaging, think about their own internal reporting, think about the value that could be created when they use recycled or sustainable materials instead of virgin,” Arthurs says.

“If we enable that data, it opens up buyers to create long-term, stable demand for processors, for collectors. And that’s what this industry really needs,” he adds. “There’s this huge amount of demand that’s out there — all these companies, all these brands that are saying they’re going to transition to sustainable plastics. We need to enable that. We need to reduce the friction in that process.”

3. Market volatility thwarts long-term investment.

Frequent changes in prices for recycled plastics are challenging for buyers and sellers that are interested in investing over the long term and trying to plan.

A Circular.co analysis illustrates the market volatility for recycled plastic: Average prices doubled from 2020 to 2021 and halved from 2021 to 2022.

4. Tailwinds are driving growth.

Drivers for adoption of more sustainable materials include increased consumer demand, sustainability-related legislation, improving economics for recyclable plastics, and technology advancements in plastic waste sorting, processing, and sourcing.

In March 2022, 175 nations signed a UN treaty targeting an end to plastic pollution. The treaty will take effect in 2024. Local legislation in the European Union and the United States is affecting the industry, as well.

California, Colorado, Connecticut, Maine, and Oregon have mandated Extended Producer Responsibility (EPR) goals; California’s law requires post-consumer plastic recycled content of 25% by 2025, and 50% by 2030. Many other US states are also considering EPR legislation.

Examples of technological advancements in plastic waste sorting include artificial intelligence-enabled systems from AMP Robotics and automated sorting solutions from Tomra Recycling.

“The level of quality of sorted plastics and bales goes up significantly with these products,” Arthurs says.

5. Headwinds are slowing adoption.

Availability, affordability, and the variability of recycled plastics continue to hinder reliable sourcing of recycled materials. Companies consistently report that they “can’t find the supply,” “recycled plastic is too expensive,�” and “recycled plastic is too variable” in quality, according to the report.

Creating plastics circularity will require dealing with these three challenges together. Technologies that reduce inefficiencies, render data transparent, and provide more reasonable economics will play a key role in solving the three-fold problem. Software, more than hardware, will drive solutions.

6. Technological solutions tackle “green premiums.”

Recycled plastic can be up to twice the price of virgin material thanks to the costs of collection, sortation, transportation, and processing. This cost difference is called the “green premium.”

The recycling industry’s lack of attractive economics and efficient infrastructure has held back PCR adoption and hobbled brands’ ability to meet their sustainability goals. They require the ability to source recycled materials quickly and to scale reliably, and the recycling industry’s traditional business methods have fallen short.

“Having worked in tech for 15-plus years, I’m used to a world where you’re able to go and find data on any element of a value chain, or any element of a product, and iterate [very] quickly. The recycling world could benefit from more open, transparent data throughout the value chain,” Arthurs says.

Data may address a material’s processing specifications, pricing, or carbon footprint, for example. Until now, the recycling industry has been relatively analog, Arthurs notes, lacking digital tools to collate data and enable easy, strategic decision-making at various levels of the value chain.

“Access to a market is actually a data challenge,” he says. “That’s the journey we’ve been on — uncovering that data and putting together a connected network that allows buyers to immediately network with suppliers, and for suppliers to network with collectors, as well. Data transparency will unlock new sources of demand, and then that stable demand drives more supply.”

Circular.co is a digital platform that enables such connections. The market data captured in the platform enable buyers and sellers to find good matches based on price, quality, and the technical specs of plastics needed and plastics available.

“The more data that’s available to us, the easier we can make decisions fast. That’s what we need,” Arthurs says.

About the Author(s)

You May Also Like