Stratasys, Desktop Metal Merger Creates Industrial 3D-Printing ‘Powerhouse’

The $1.8-billion deal unites Stratasys’ polymer-based 3D printing expertise with the industrial mass production acumen of Desktop Metal.

May 26, 2023

3D printing companies Stratasys Ltd. and Desktop Metal Inc. announced that they have entered into a definitive agreement to combine the companies via an all-stock transaction valued at approximately $1.8 billion. Described by Desktop Metal co-founder and CEO Ric Fulop as a “turning point in the next phase of additive manufacturing for mass production,” the deal brings together the polymer-based 3D printing expertise of Stratasys with the industrial mass production leadership of Desktop Metal’s brands.

The agreement was unanimously approved by the boards of directors of both companies. The deal is expected to close in Q4 2023.

|

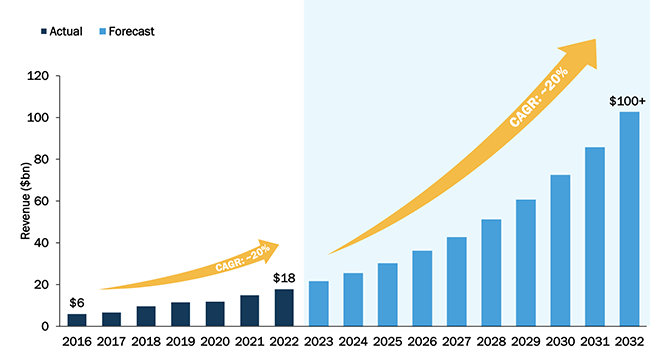

Based on data from Wohler's 2023 report, the 3D printing market is forecast to grow to $100 billion by 2032. |

Combined company covers full manufacturing spectrum

Stratasys and Desktop Metal are expected to generate $1.1 billion in 2025 revenue, with significant upside potential in a total addressable market of more than $100 billion by 2032, said the companies. As the first industrial additive manufacturing company covering the full manufacturing lifecycle from design to production in both polymers and metals on a global scale, it will be well positioned to take advantage of new dynamics in the 3D printing market. Notably, the shift toward mass production will continue to grow the market by approximately 20% CAGR, reaching a value of more than $100 billion by 2032, according to projections provided by the companies based on data from Wohlers.

“With attractive positions across complementary product offerings, including aerospace, automotive, consumer products, healthcare, and dental, as well as one of the largest and most experienced R&D teams, industry-leading go-to-market infrastructure, and a robust balance sheet, the combined company will be committed to delivering ongoing innovation while providing outstanding service to customers,” said Stratasys CEO Dr. Yoav Zeif.

“We are excited to complement our portfolio of production metal, sand, ceramic, and dental 3D printing solutions with Stratasys’ polymer offerings,” said Desktop Metal’s Fulop. “Together, we will strive to build an even more resilient offering with a diversified customer base across industries and applications in order to drive long-term sustainable growth.”

$35 billion opportunity in 3D-printed dental market

One potential high-growth area highlighted by the companies during a presentation on May 25 is dental mass production. Since Q1 of 2023, 3D-printed dental restorations have been eligible for reimbursement by insurance companies, creating a “$35 billion opportunity for additive manufacturing to grow from less than 5% to more than 80% in this decade,” according to the companies. They are well positioned to be a market leader in this sector thanks to:

A current strategic partnership with Align Technology, a manufacturer of 3D digital scanners and Invisalign clear aligners for orthodontia;

more than 70 dental and biofabrication materials, including the popular Flexcera and Truedent brands;

Desktop Labs' digital dental and biofabrication platform that enables chair-side printing.

Following close of the transaction, Zeif will lead the combined company as CEO together with Fulop as chairman of the board. Upon the deal’s completion, the combined company’s board of directors will comprise 11 members, with each company selecting five of them. CEO Zeif will be the eleventh member. Stratasys Chairman Dov Ofer will serve as lead independent director of the combined company.

Financial details of the transaction

Desktop Metal stockholders will receive 0.123 ordinary shares of Stratasys for each share of Desktop Metal Class A common stock. This represents a value of approximately $1.88 per share of Desktop Metal Class A common stock based on the closing price of a Stratasys ordinary share of $15.26 on May 23, 2023. Following the closing of the transaction, which is expected to occur in the fourth quarter of 2023, existing Stratasys shareholders will own approximately 59% of the combined company, and legacy Desktop Metal stockholders will own approximately 41% of the combined company, in each case, on a fully diluted basis.

About the Author(s)

You May Also Like