Plastic continues to grab market share from glass in drug packaging

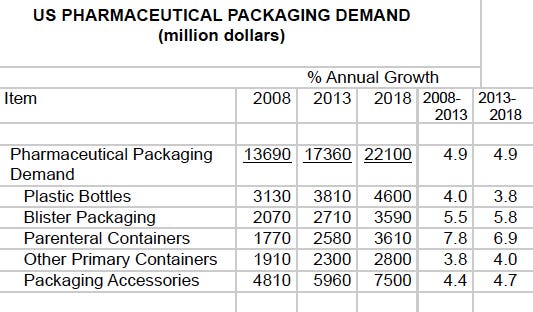

The market for glass pharmaceutical bottles will decrease as plastic bottles and blister packs continue to replace glass in oral drug packaging applications, according to a new report from the Freedonia Group (Cleveland, OH). Overall U.S. demand for drug packaging products will increase 4.9% per year to reach $22.1 billion in 2018, adds the business research company.

July 29, 2014

The market for glass pharmaceutical bottles will decrease as plastic bottles and blister packs continue to replace glass in oral drug packaging applications, according to a new report from the Freedonia Group (Cleveland, OH). Overall U.S. demand for drug packaging products will increase 4.9% per year to reach $22.1 billion in 2018, adds the business research company.

Primary pharmaceutical containers will make up two-thirds of total demand, with the remainder generated by closures, secondary containers, labels, and other packaging accessories. "Led by prefillable syringes, vials, and premixed IV systems, parenteral containers will post the fastest growth in both revenue and unit demand, as new injectable and infusion therapies based on biotechnology and other advanced life sciences are introduced into the marketplace," says analyst Bill Martineau in a statement distributed by the company. "Demand for these containers will exceed that for blister packaging and will generate the second largest share of value demand among primary pharmaceutical containers in 2018."

Plastic bottles will continue to record the largest demand among primary pharmaceutical containers, reflecting usage in the bulk and prescription dose packaging of oral ethical drugs and the packaging of solid-dose oral over-the-counter medicines in large quantities.

Blister packaging will remain the leading competitor to plastic bottles in solid oral drug applications and, overall, will post above average revenue growth based on adaptability to unit dose and clinical trial dosage formats with expanded label content, high visibility, and built-in track-and-trace features, says Freedonia.

The value of demand generated by prefillable inhalers will expand somewhat faster than the overall average of primary pharmaceutical containers, as the devices build applications in the delivery of asthma, COPD, and, most recently, insulin therapies.

By contrast, the market for pharmaceutical pouches will grow at a slightly below average pace, as uses remain limited to the unit dose packaging of transdermal, powder, and topical medicines.

Dispensing closures, parenteral stoppers, security-enhanced labeling, and intelligent components will see the fastest revenue growth of pharmaceutical packaging accessories.

These and other trends are presented in Pharmaceutical Packaging Products, which can be purchased on the Freedonia website.

About the Author(s)

You May Also Like