Thin-Wall Packaging: Where Weight Loss is a Sustainability Gain

The market for lightweight thin-wall packaging, which sustainably reduces plastic use to lower transportation and energy costs, is growing 6.4% yearly.

At a Glance

- Thin-wall packaging market is growing 6.4% yearly

- Thin-wall plastic is widely used in food and beverages, especially dairy products

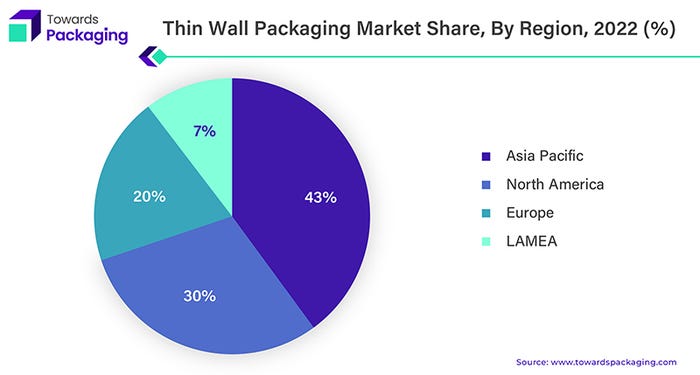

- North America dominates with 30% of the global market

Thin has been “in” for decades as one of the foundational “Four Rs” approaches to improved sustainability, reduce.

It’s a strategy seen in simplified barrier structures for flexible packaging — that typically are also recyclable — and in reduced material use in rigid containers.

It’s in rigids where one finds thin-wall packaging, which is defined by a new market report from Towards Packaging as “packaging materials characterized by a thin and lightweight design.”

Thin-wall packaging is said to generally involve the use of materials such as plastics, in particular PET, polypropylene (PP), and other lightweight polymers.

Because plastic packaging usually has distinct advantages over material alternatives such as paper, glass, or aluminum, thin-wall plastic packaging takes these advantages to the next level.

The market is projected to reach a global value of $76.77 billion by 2032, rising at a 6.4% CAGR from $49.9 billion in 2023, reports Towards Packaging.

Thin-wall packaging is such a popular topic that it’s the subject of a yearly conference.

Thin-wall packaging: key products and regions.

Thin-wall plastic packaging has become ubiquitous in many industries, notably food and beverages.

For food, thin-wall packaging is extensively employed for dairy containers, including yoghurt cups, and frozen foods, fruits, vegetables, bakery items, ready meals, juices, soups, and meats.

It’s also adaptable beyond traditional applications as a replacement for glass and cans in commodities such as meat and preserves. This creates new marketing opportunities.

Two main segments stand out within the thin-wall packaging market: open-top containers and lids.

Open-top plastic containers, a prevalent choice in this market, are commonly used for packaging frozen food or fresh food items and paint, adhesives, cosmetics, and pharmaceuticals.

From a regional view, North America's substantial role in the thin-wall packaging market is represented by a 30% market share.

TOWARDS PACKAGING

Across the globe, the Asia-Pacific (APAC) region played a pivotal role in the global plastics landscape, contributing over half of the world's plastic production at 51% of the total 390.7 million metric tons. As a major hub for plastic manufacturing, the APAC region stands poised to lead the transition towards a circular economy for plastic packaging. China, the largest global consumer of plastics, and India represent key markets for plastic packaging within the APAC region, experiencing heightened demand as consumers shift towards packaged goods.

China dominates plastics manufacturing with 31% of the world's plastic production. Other Asian nations, including Japan, contribute significantly, making up 3% of global plastic production, with the rest of Asia accounting for 16%. The APAC single-use plastic packaging market is anticipated to grow at a CAGR of 5.66% until 2030, emphasizing the region's continued influence in the global plastic packaging landscape.

Thin-wall packaging: a caveat, news, and references.

However, before companies consider changes around thin-wall packaging, Bob Lilienfeld, executive director, SPRING, shares a cautionary note from a holistic view.

“Thin-wall packaging needs to be considered a part of an entire supply chain perspective,” the sustainable packaging expert tells us. “A typical lifecycle assessment based primarily on source reduction will make it seem like the right decision. But if increased product breakage or spillage occurs, either because the package is no longer strong enough, or secondary packaging such as paperboard cartons can no longer protect the primary package without a fiber/weight increase, thin walling is probably the wrong answer.”

Griener's injection-molded, thin-wall recycled PET cup noted below fits the needs of a circular economy.

The report notes these significant developments in thin-wall plastic packaging:

In October 2023, Asian packaging vendor Cosmo Films launched new business, Cosmo plastech, which offers thin wall sheets and containers.

In October 2023, Netstal launched a lightweight ICM thin wall cup made completely of PP.

In October 2022, OQ, an Oman-based fast-growing firm, expanded its product line by introducing Luban HP2151T, a high-flow reactor (60 MFI) grade PP homopolymer aimed for thin-wall packaging applications.

Links to appropriate PlasticsToday content:

Injection Molding of Thin-Walled rPET Cups Is Now Possible, published April 2023;

Automated Molding Cell Economically Produces Thin-Walled Packaging with Recycled Content, published January 2022

More on thin-wall packaging is available here.

About the Author(s)

You May Also Like