Brazil: A cadeia do plástico (The plastics chain)

These days in Brazil there is a lot of talk about the country’s emerging plastics chain, with links extending upstream to its state-run oil and gas companies; through the emerging petrochemical and plastics giant Braskem; down to the nearly 12,000 converters of resin in the country (plus the machinery suppliers that equip them); and finishing with the expanding middle class, whose consumption of plastics grows in direct correlation to their own climbing income.

September 9, 2010

These days in Brazil there is a lot of talk about the country’s emerging plastics chain, with links extending upstream to its state-run oil and gas companies; through the emerging petrochemical and plastics giant Braskem; down to the nearly 12,000 converters of resin in the country (plus the machinery suppliers that equip them); and finishing with the expanding middle class, whose consumption of plastics grows in direct correlation to their own climbing income.

In coming years, that chain’s natural expansion will be supplemented by the arrival of two of the world’s largest sporting events: soccer’s World Cup in 2014 and the Summer Olympics in 2016.

As the clock ticks toward these mega events, the country will reach some important milestones. According to GBI Research, Brazil will become Latin America’s largest crude oil producer, surpassing Venezuela and Mexico, by 2015. The 10th-largest economy in the world now, Brazil is forecast to leapfrog to number five by 2016. The country, with a total land area just shy of the continental U.S. and 193 million inhabitants for the fifth-largest population globally, is already the world’s second-biggest food exporter and seventh-largest consumer market.

Packaging powerhouse

|

That combination of food and consumers is stimulating a vibrant packaging industry in the country. This is evident in Brazil’s per capita plastic consumption, which rose 2 kg (almost 4.5 lb) over the six years from 2001-2006 to 25 kg before shooting up another 2 kg in just the last four years to 27 kg today (for perspective on growth potential, per capita plastics consumption in the U.S. is more than 130 kg by some accounts). From 2005-2006, Brazil increased its exports of converted plastic goods 24% to $1.048 billion, and increased them again in 2007 to $1.185 billion, with the main destinations being the United States, Argentina, and China. According to the country’s Export Plastic program, from 2002-2007 the total revenue of the plastic-converting industry rose more than 131% from $8.083 billion to $18.698 billion.

In a presentation in São Paulo, Gilberto Agrello, plastic housewares and rigid packaging market development specialist at Export Plastic, said that going forward, the main target markets for plastic exports will be the U.S., Spain, South Africa, Chile, Colombia, Peru, and Panama. Products that Brazilian processors will offer in flexible goods include films (stretch, shrink, laminated, coextrusion, form-fill-seal), big bags, geomembranes, and woven bags. In rigid goods, it will promote disposables, closures, housewares, and thermoformed packaging.

Agrello did note that the industry was not immune to the financial contagion that infected the world last year, with Brazilian plastics experiencing a blip in its otherwise uninterrupted growth. Revenue from converting dropped from $21.9 billion in 2008 to $18.0 billion last year. Exports, which rose nearly 250% from 2002-2008, fell off as well, from $1.392 billion in 2008 to $1.187 billion in 2009.

Full speed ahead

Along the aisles of the 26th FISPAL (International Fair of Packaging & Processing for the Food & Beverage Industry; São Paulo; June 8-11), exhibitors and attendees indicated that a boom in the domestic market’s activity over the first five months of 2010 had made 2009’s hiccup seem an anomaly.

José Ricardo Roriz Coelho, president of the Brazilian Plastics Industry Assn. (ABIPLAST; São Paulo) as well as biaxially oriented PP (BOPP) film processor Vitopel, said that in the first quarter the local industry experienced a year-over-year expansion of 22%. That “very important growth,” according to Coelho, came in a variety of industries, including building and construction, automotive, flexible packaging, and rigid food/beverage packaging.

To continue such growth, however, Coelho believes the industry will have to undergo some changes. “Brazil needs to invest much more in innovation,” he said. “We are producing low-cost products and importing higher-cost goods.” Coelho and others agreed that consolidation in Brazil’s plastics industry is also long overdue. Of the approximately 11,500 converters, the majority have output of less than 12,000 tonnes/year. The resulting scale is insufficient to effectively negotiate with the global titans like Walmart, Unilever, Carrefour, and Coca-Cola that are courting the country’s consumers.

Regardless of its current scale, the Brazilian plastics industry seems poised for overall long-term growth. As a comparison, 2006 data released by the Society of the Plastics Industry (SPI; Washington, DC) reported that the U.S. plastics sector shipped $379 billion worth of goods and employed 1.1 million workers across 18,585 facilities throughout the country.

Brazil price vs. China price

Fellow BRIC (Brazil, Russia, India, China) country China was a frequent topic of conversation during FISPAL and the co-located Export Plastic Buyer Project, where foreign visitors are paired with potential Brazilian suppliers on the basis of their needs. These discussions typically centered on two things: continued efforts by China to penetrate Brazil’s market for plastics goods, materials, and the machinery used to create them; and whether or not Brazil could leverage its chain to compete with the Asian behemoth on price.

One plastics converter based in Colombia and invited to participate in Export Plastics Buyer Project considered Brazil a backup plan in case China is forced by western countries to revalue its currency. This individual was confident that “Brazil could match the China price if they wanted to,” and that sentiment was shared by ABIPLAST’s Coelho, and many others.

“[Brazil] can be very competitive with other prices,” Coelho said. On the country’s side, he adds, are readily available labor, a booming local food industry that can co-locate packaging, local machinery suppliers, burgeoning ethanol (and bioplastic) production, and greater domestic supplies of petroleum than China. But the country has ceded some ground to China in terms of markets, with many local converters moving out of strictly commodity goods and targeting value-added segments like high-barrier packaging.

Challenges to overcome

One of Brazil’s potential obstacles can also be described as an advantage: Braskem. Owned by the largely state-run oil and gas company Petróleo Brasileiro SA (Petrobras; Rio de Janeiro), Braskem, which produces polyethylene, polypropylene, and polyvinyl chloride, enjoys a near monopoly on the local market, with processors who import materials forced to pay tariffs. As a result, industry representatives MPW spoke with largely conceded that the cost of raw materials in Brazil can be higher than in other countries.

“I think it will be very difficult for small companies to compete because we have only one supplier of material,” Coelho said, stressing the scale needed in purchasing. He also believed that Braskem has responsibility to the local market. “The chain needs to be competitive; if Braskem will not sell to Brazil, and they sell to overseas, they have to be competitive.” Coelho did say that at present, materials are imported into Brazil mainly due to a technology requirement, not due to price. (Braskem declined to answer questions).

Alfredo Schmitt, president of the Brazilian Assn. of Flexible Plastic Packaging Manufacturers (ABIEF; São Paulo) and FFS Filmes Ltda. (also São Paulo), said that ultimately, plastics, like other commodities, trade in line with international benchmarks. “I think pricing is global; sure you have price plus, but if Braskem increases prices too much, I ask, where will they go to sell raw materials?” Schmitt said. “It’s very important to have a fine calibration of prices. Braskem has a responsibility to the market.” Schmitt said Brazil, which is also rich in minerals and metals, maintains a default position to source locally with 83% domestic production of all the raw materials it uses.

Regardless of its desire for self sufficiency and in spite of the rapid expansion of its own industry, Brazil will continue to look outside its own borders to fully satiate its plastics demand, giving plastics businesses the world over a sales opportunity in the southern hemisphere. Coelho believes the country will run a plastics deficit for at least another five years, even as it makes huge investments in its own capacity. How huge? In 2009, the Brazilian plastics industry invested $2.1 billion in machinery, a figure likely to rise as the Olympics and World Cup approach. “All the world is looking at Brazil,” Agrello said. “It’s an opportunity.”

Fast facts: Brazil’s plastics industry

• 11,500 converters

• 323,000 employees

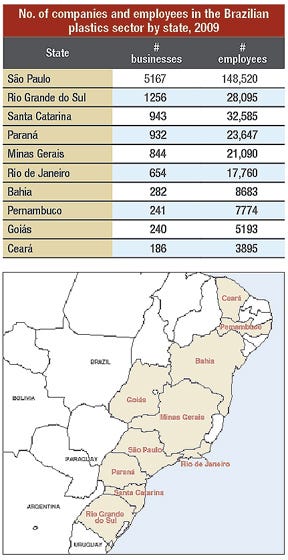

• Excluding Mexico, Brazil accounts for 50% of the Latin American plastics market

• 50% of Brazil’s plastics industry is in São Paulo

• Brazil has a 19% recycling rate for plastics

• Brazil to become the third-largest automaker in the world

• Resins have a 14% import duty

• Duties waived for machinery that isn’t made locally

About the Author(s)

You May Also Like