Chinese machinery manufacturers continue expansion despite broader economy’s “slowdown”

Only in China can GDP growth rates approaching 10% suggest a slowdown, but after its most recent peak in 2007, when the economy expanded by a blistering 14.7%, the Chinese economy proceeded to yo-yo over the next four years, falling to 9.6% in 2008 and 9.2% in 2009, before jerking upwards to 10.4% in 2010, and subsequently dipping once more to 8.7% growth in 2011.

May 8, 2012

Only in China can GDP growth rates approaching 10% suggest a slowdown, but after its most recent peak in 2007, when the economy expanded by a blistering 14.7%, the Chinese economy proceeded to yo-yo over the next four years, falling to 9.6% in 2008 and 9.2% in 2009, before jerking upwards to 10.4% in 2010, and subsequently dipping once more to 8.7% growth in 2011.

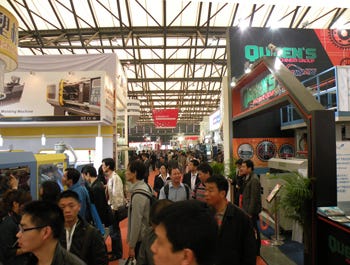

In that atmosphere of uncertainty, Chinaplas 2012 opened in Shanghai, seemingly oblivious to the macroeconomic retraction, notching a new record with more than 210,000 sq m (2.26 million sq ft) of booked space, up better than 10% from 2011. In fact, in the five years since the Chinese economy's most recent peak in 2007, Chinaplas has seen 106% growth in total exhibition area, 70% growth in the number of exhibitors, and 62% growth in the number of visitors, according to show organizer, Adsale.

Asked about the Chinese "slowdown", one exhibitor looked around the teeming halls of the Shanghai New International Exhibition Centre and responded with a question of his own, "What slowdown?"

Despite that individual's rhetorical response, many exhibitors did acknowledge that business has retracted in recent years, particularly for those companies whose customers make goods for export to the U.S. or Europe. Even so, the China and Hong Kong based machinery companies PlasticsToday spoke with said they still enjoy enviable rates of expansion, especially compared to their western counterparts.

A hard or soft landing

"China is slowing down, there's no doubt about it. Now it's just a question of whether it will be a hard or a soft landing," explained Stephen H.C. Chung, executive director of Hong Kong based Chen Hsong Group. "I think soft."

"Frankly speaking, the last couple of years have not been very good. Most of the production in China, our customers, have been those making things for export. [Chen Hsong] has had to adapt and get into a lot more domestic manufacturers."

Chinaplas 2012 crowd |

Chinaplas 2012 |

Chinaplas 2012 |

Chung said that Chen Hsong sold about 15,000 machines in 2011, with 80% of those delivered into China, adding that business seemed to be shifting to a more "rational" level, with a market like automotive growing by 30% vs. 60%. "The sooner it gets down to sustainable levels, the better," Chung said.

Having already partnered with U.S. firm Gluco (Grand Rapids, MI) to gain further entrée into North America, the company also opened a wholly owned Brazilian operation in 2012, as it bids to increase sales outside of China. Following the global economic crisis of 2008, the company has worked to augment its staff, which it cut in response to the downturn. "Since 2009, we've had to rebuild our work force; it took a couple of years to ramp up," Chung said, noting Chen Hsong currently has openings at various levels in all its departments.

As it ramps back up, the company is working to increase its presence in the automotive sector, launching a new line of 2-platen injection molding machines. One recent order of a 6500-ton press will be used to make very large trash bins.

Ningbo, China headquartered, Haitian International, regarded as the largest supplier of injection molding machines in the world in terms of volume with annual production of 30,000 machines, reported in an earnings release total 2011 revenue of 7 billion RMB ($1.1 billion) "in spite of the macroeconomic challenges in 2011," with export sales up by 17.3% compared to 2010. The company described the result as being near a record for revenue, with gross profit margins steady at 29.7% and net profits achieving a new record of RMB 1.103 billion ($174.9 million).

In that earnings release, Zhang Jianming, executive director and CEO of Haitian International, said his company had a strong business performance "despite the tightening measures of the Chinese Government" and other "macroeconomic" challenges.

No. 3?

While the top two regional machinery manufacturers are widely accepted to be Haitian and Chen Hsong, No. 3 is a matter of some dispute, with market watchers alternatively giving the nod to relative newcomer Guangzhou based Borch Machinery Co. Ltd. or Donghua Machinery Ltd., part of Hong Kong's Cosmos Machinery Enterprises Ltd. group, which markets the Welltec Machinery brand outside of China.

Simon Ho, marketing and international trade department director, Cosmos Machinery Ltd.'s Dongguan office, said his entire company had total 2011 turnover of HK $24 billion ($2.72 billion), with RMB 1 billion ($158 million) in machinery turnover. Ho said 80% of the machines his company sells are sold into China, although the export market, led by Brazil, grew by 40%. "The market is getting better now, since March," Ho said. "It had slowed down."

Joe Tang, director of sales and marketing at Borch, said his company, which is only eight years old, was selling about 12,000 machines/yr, led by the automotive and household markets, respectively, with China representing 70% of its sales and its second biggest market also in Brazil. Tang said Borch has grown so quickly on the basis of "technology, good technology", with a focus on middle- to high-end high-speed injection molding machines, ranging from 30-4500 tonnes. The company had four machines on its stand, including one with five separate injection units. A nod to the higher technology segments its targeting.

About the Author(s)

You May Also Like