ExxonMobil Chemical makes metallocene polyethylene push at NPE2012

"Right now, North America is in the driver's seat for polyethylene," stated Jeffrey Beck, global marketing manager polyethylene (PE) at ExxonMobil Chemical. Beck's comment in an interview with PlasticsToday at NPE2012 reinforced how beneficial the natural gas boom, and the prolific amounts of cheap ethane it has made available to petrochemical producers in North America, has been, and how it has changed the dynamics of global polyolefin supply.

April 16, 2012

"Right now, North America is in the driver's seat for polyethylene," stated Jeffrey Beck, global marketing manager polyethylene (PE) at ExxonMobil Chemical. Beck's comment in an interview with PlasticsToday at NPE2012 reinforced how beneficial the natural gas boom, and the prolific amounts of cheap ethane it has made available to petrochemical producers in North America, has been, and how it has changed the dynamics of global polyolefin supply.

If North America is in the driver's seat, ExxonMobil Chemical, with its feedstock flexibility; Exceed and Enable metallocene polyethylene (mPE) technology; and propylene-based elastomer Vistamaxx, could very well be riding shot gun.

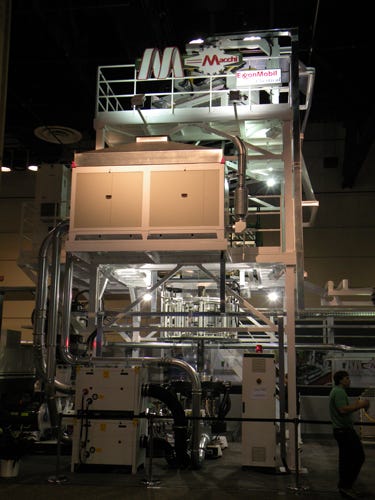

Macchi running ExxonMobil Chemical PE at NPE2012 |

Macchi ran two films at NPE2012 utilizing ExxonMobil Chemicals' Exceed and Enable mPE resins. |

Beck, and Dave Dunaway, Americas PE market development manager for polyolefins, pointed to slowing growth rates for legacy polyolefins like low-density polyethylene (LDPE), which expands at around 1%/yr, or linear low-density polyethylene (LLDPE), which at 20 years of age has slowed to a growth rate of 4.5%/yr, to the so-called high alpha olefins (HAO), made from C6 or higher building blocks, that expand at 10% or more annually.

Both noted recent rumblings about actual new cracker builds in the U.S., something that hasn't happened in decades, with capacity expansions of late coming via refinery and cracker de-bottlenecking. All of it represents the desire to capitalize on shale gas, and a historically high crude to gas price ratio, at times pushing 50:1, given $100/bbl petroleum and $2 mm/btu gas.

"We do know that a lot of gas has come unto the market, and will continue to, cheaply," Beck said. "If you can run ethane, you benefit."

A fundamental question

Cracker construction, and the billion-dollar-plus investment it would entail, seems like a tipping point of sorts for North America, which not very long ago had been forecast to become a net importer of plastics, but for large established players like ExxonMobil Chemical, which can run light and heavy feedstocks, some caution is in order.

"The be question is, 'Is [the shift] fundamental or not?'" Dunaway said. "That's the big issue we grapple with." Dunaway also noted that if a petrochemical facility runs a cracker based on ethane, the resulting byproduct is almost exclusively ethylene, opening the door for alternative propylene production methods, including on-purpose propylene.

The ultimate goal for the company is a desire for feed and product flexibility around the world, which ExxonMobil Chemical got closer to when it recently produced metallocene polyethylene in Singapore for the first time. That site will feature a 1.3 mm/tonne capacity expansion, that's not complete yet. Once it is, the goal is global supply of mPE, supplying Asia locally and supplementing other regions when there's a demand spike.

NPE the place to be

At NPE2012, the company allowed existing and prospective customers to schedule one-on-one consultations with its technical experts or see ExxonMobil Chemical material running on the show floor. These live demonstrations included 50-micron lamination film and a 40-micron collation shrink multipack film with Exceed and Enable MPE resins (Macchi); a 15-micron draw tape bag film with Exceed mPE (CMD Corp.); thermoformed parts from ExxonMobil PP and Vistamaxx propylene-based elastomers (OMV-USA), and a dampening element molded with Santoprene TPV in a multicavity mold (Engel).

About the Author(s)

You May Also Like