Plastics processing equipment sales dip second quarter in a row

Demand will start to rise again in 2017, according to a report from the Committee on Equipment Statistics of the Plastics Industry Association (Washington, DC).

March 13, 2017

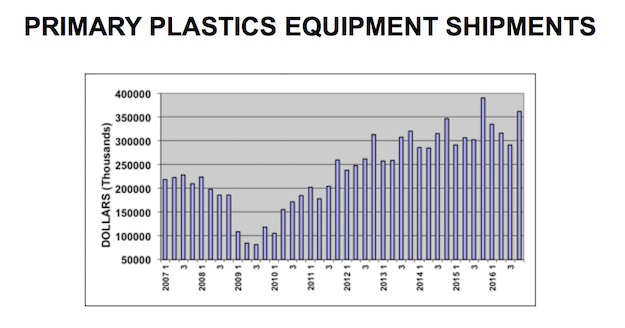

North American shipments of plastics machinery posted the first back-to-back quarterly declines since the recovery from the Great Recession began for the plastics industry in 2010, according to statistics compiled and reported by the Plastics Industry Association’s (PLASTICS; Washington, DC) Committee on Equipment Statistics (CES).

The preliminary estimate for shipments of primary plastics equipment, which includes injection molding, extrusion and blowmolding equipment, for reporting companies totaled $361.7 million in the fourth quarter. This was 7.4% lower than the total of $390.6 million from Q4 of 2015, but it was 24.2% higher than the $291.3 million from Q3 of 2016. For the entire year, shipments of primary plastics equipment were up 1.2% when compared with the annual total from 2015.

“After rising steadily for six years, shipments of plastics equipment hit a plateau in 2016. The annual total was just high enough to extend the string of annual increases to seven years,” said plastics market economist Bill Wood of Mountaintop Economics & Research Inc., who provided analysis for the CES report. The sales slump may continue into the first half of 2017, he added, “but the underlying economic fundamentals will gradually improve. If Congress passes corporate tax reform in 2017, then the uptrend in this data may re-emerge later this year.”

Shipment value by equipment categories between Q4 2014 and Q4 2015 were as follows:

Injection molding machinery decreased 12.1%;

single-screw extruders dropped 9.2%;

twin-screw extruders, which include co-rotating and counter-rotating machines, fell by 8.1%;

blowmolding machines increased 9.1%.

New bookings of auxiliary equipment for reporting companies totaled $126.6 million dollars in Q4 of 2016. This represented a slight 0.1% decline from Q4 of 2015, but it was a gain of 5% when compared with the total from Q3 2016.

The decline in the CES machinery data in the fourth quarter, as well as the modest gain for the entire year in 2016, were comparable to the performance posted for the entire industrial machinery sector. According to data compiled by the Census Bureau, the total value for new orders of U.S. industrial machinery dropped 1.6% in Q4 of 2016 when compared with the total from Q4 of 2015. For 2016 as a whole, total new orders for industrial machinery increased by 0.6%.

Another indicator of demand for plastics machinery is compiled and reported by the Bureau of Economic Analysis (BEA) as part of the U.S. GDP dataset. According to the BEA, business investment in industrial equipment increased 2.6% at a seasonally adjusted, annualized rate in Q4 of 2016 when compared with Q4 of 2015. For the year 2016, investment in business equipment rose 2.9%.

"After a modest decline in 2016, overall demand for plastics products in the U.S. will start to rise again in 2017,” said Wood. “Our forecast for the economy in 2017 calls for annual, real GDP growth in the range of 3% due primarily to steady improvement in wages and household incomes resulting from stronger employment levels," said Wood.

The CES also conducts a quarterly survey of plastics machinery suppliers that asks about expectations for the future. According to the Q4 survey, 91% of respondents expect market conditions to either hold steady or get better during the next year. This is up from 86% in the previous quarter.

The outlook for global market conditions also improved in the third quarter. North America was the region with the strongest expectations for improvement in the coming year. Mexico is expected to be steady-to-better. The outlooks for Asia and Latin America continue to be more optimistic than they were in the previous quarter, while the outlook for Europe weakened modestly, according to the CES report.

Medical and packaging are the end-markets that will enjoy the best growth in demand for plastics products and equipment in the coming year. The expectations for automotive demand improved after a sharp dip in the previous quarter. Expectations for all other end-markets call for steady-to-better demand to prevail in 2017.

About the Author(s)

You May Also Like