Profitable Plastics: Profit is the Thing

In general, businesses with commodity price risk (e.g. oil companies, transportation companies ... and resins processors) manage that risk to achieve different objectives - cost certainty, budget or forecast targets, job and business security, competitive advantage, customer loyalty, etc. IMHO, the primary purpose of managing commodity price risk should be to secure and improve profit margins. Profits keep the doors open and people employed. Resins processing may be tons of fun, but profit is the thing.

August 28, 2012

In general, businesses with commodity price risk (e.g. oil companies, transportation companies ... and resins processors) manage that risk to achieve different objectives - cost certainty, budget or forecast targets, job and business security, competitive advantage, customer loyalty, etc. IMHO, the primary purpose of managing commodity price risk should be to secure and improve profit margins. Profits keep the doors open and people employed. Resins processing may be tons of fun, but profit is the thing.

For processors, managing profit margins means controlling (hedging!) resins costs consistent with the way revenues are generated: the timing and type of resin cost hedges should reflect the timing and nature of product sales. In simplest terms, what you do with one side of the operation should take into account what's happening on the other side. (Think oil refinery and crude oil costs. Hedging crude oil costs independent of gasoline pricing isn't hedging. It's betting.)

Resins costs beyond immediate needs (i.e. medium to long-term) should only be locked in against fixed and certain product prices. If product prices need to be flexible to respond to competitive and customer pressures, then resins costs should be capped, not locked in. In other words, if you can't easily raise product prices to offset higher resins costs and profit margins are tight, then capping resins costs is the right and most prudent hedging strategy. (How to cap resins costs will be a major topic in this column going forward.)

Commodities costs are usually controlled (hedged!) with financial tools for reasons such as cost effectiveness, better buying decisions, capital constraints, etc. But financial transactions and the physical transactions they substitute for need to be in sync as much as overall cost control needs to be in sync with revenue flow.

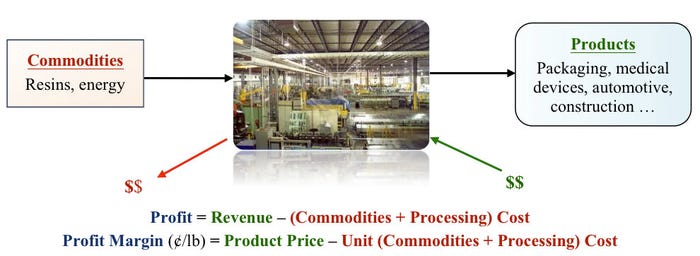

Consider the generic processor:

Profitable Plastics

Processors like the generic processor who focus on and manage margin risk will outperform and outlast competitors because they spend more time meeting customer needs and wants and less time worrying about profits.

Some upcoming topics in Profitable Plastics:

What is a hedge? What hedging tools are available for resins processors?

Are there hedging rules of thumb? Are some hedges better than others?

The forward curve: what is it? What is it used for? Where do I find it?

Capping resins costs

Increasing revenues

Suggestions from readers like you

And lots more

About the author: Tom Langan is a commodity risk management consultant dba WTL Trading. He provides education and front-line services to processors and suppliers to help control resin price risk, increase revenues, and secure profit margins. His email is [email protected].

About the Author(s)

You May Also Like