The Hedging Corner: 20% gross margin for processors, price certainty for customers

According to a recent study (as reported by Clare Goldsberry, PlasticsToday, 27-June-11), 'earnings before interest, taxes, and owners' compensation for 150 plastics processors averaged little more than 8%. For the last 15 years, the return was just 5% to 7%.

July 19, 2011

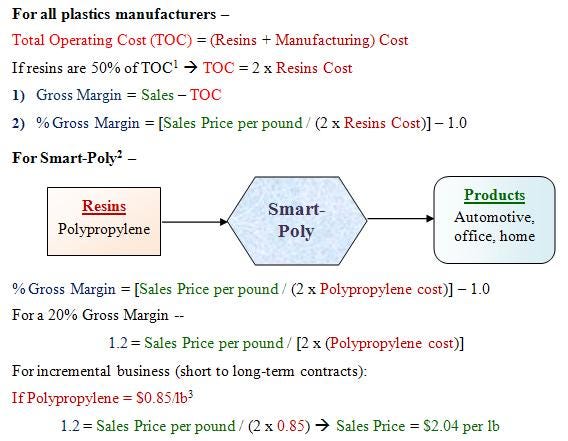

According to a recent study (as reported by Clare Goldsberry, PlasticsToday, 27-June-11), 'earnings before interest, taxes, and owners' compensation for 150 plastics processors averaged little more than 8%. For the last 15 years, the return was just 5% to 7%. Meanwhile, utilization of injection molding machinery is also low, averaging less than 40% on a 24/7 basis.' Plastics processing is tough business, made tougher by offshore competition and weak companies who 'routinely low-ball quotes to keep the presses running'. However, processing is a lot harder than it has to be. Fear or unwillingness among processors to understand and apply cost and sales pricing tools (futures, swaps, options, etc.) to benefit themselves and their customers make it so. Why not earn 20% and have happy customers at the same time? Here's one way --

Smart Poly

Smart-Poly's incremental price for any of its products is tied to the market price of polypropylene. Their target margin is 20% and they offer their products at fixed prices for whatever duration requested by the customer. Customers obtain price certainty and are not exposed to cost adders for Smart-Poly's resin costs. Smart-Poly leaves its competitors, stuck on the Standard pricing model, wondering how Smart-Poly stays in business. Smart-Poly laughs all the way to the bank.

Smart-Poly simply provides customers the first of the three pricing choices discussed last week in the Hedging Corner - the 'fixed price with no cost-adder' choice, common in energy and other markets. This choice is particularly attractive to customers who want to avoid cost-adders and meet or beat their budgets or other objectives for product purchase costs.

The above is somewhat abridged. If you would like details or more information on pricing choices to benefit you and your customers, email me at [email protected]. You can join 'Smart-Poly' and scoff at a margin of 8%.

Coming in next week's Hedging Corner: Smart-Poly gets smarter. They offer two more pricing choices -- fixed prices with downside price protection, and price caps. Now their offshore competitors are feeling the heat.

(1) 50% was chosen to simplify the math. The figure is closer to 45% according to Resin Pros

(2) Fictitious name for a smart processor

(3) Average delivered contract price for polypropylene per Plastics Exchange data on 18-July-2011

Tom Langan is a risk management consultant who operates WTL Trading. His focus is commodity cost control, margin improvement, and revenue development for manufacturers and their customers.

About the Author(s)

You May Also Like