Price Wise: A new paradigm for resin prices

In last week's Price Wise [Better Resins Futures], I proposed replacing CME's moribund resins futures contracts with spread contracts against crude oil futures.

September 27, 2011

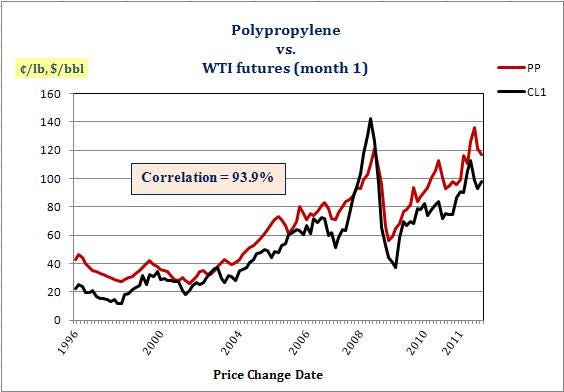

In last week's Price Wise [Better Resins Futures], I proposed replacing CME's moribund resins futures contracts with spread contracts against crude oil futures. Crude oil prices drive resins prices (see discussion on my website, and here and here in Price Wise). Crude oil futures are transparent, fair, liquid, option-able, and are executable months and years ahead. Converting resins prices to spreads against crude oil makes them transparent, fair, liquid, option-able, and controllable years ahead - everything they aren't now. For purchasing managers, that means no more wondering or concerns about price 'fairness' for spot purchases and, similarly, no more vulnerability to an index price for contract purchases.

Regardless of what CME does with its resins futures contracts, a spread price to crude oil opens a wide avenue for processors (and suppliers) to effectively and economically manage resins prices vis-à-vis product sales prices and, therefore, protect and improve profit margins.

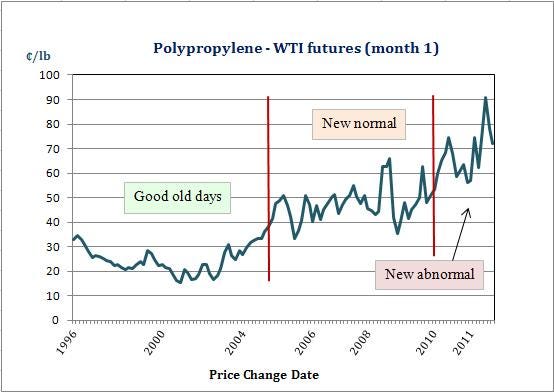

In the case of polypropylene -

Converting the WTI price to ¢/lb and taking the difference yields a price spread curve --

|

In the 'good old days' of cheap oil (below $50/bbl), the spread averaged 25 ¢/lb. When crude oil leaped to trading in or near three digits (the 'new normal'), the average spread blew out to 50 ¢/lb. In 2010, the 'new abnormal' appeared and will remain until the pipeline-constrained supply glut of WTI at Cushing, OK is relieved. (See discussion here.) When that occurs - hopefully, within the next twelve months - expect a return to the 'new normal'. Until then, it appears the spread will average 70 ¢/lb.

Price spread for any resin

Using historical data, a fair price spread may be determined for any resin, not just for high-volume resins like polypropylene. In fact, when and if polypropylene trades as a price spread against crude oil, other resins prices may be established as price spreads against polypropylene, which then makes them transparent, fair, and so forth.

Price spread is key

The price spread becomes the traded and negotiated variable between processors and suppliers, rather than the absolute (or outright) price, which is much more difficult to agree on. When this occurs, market information providers need only switch from outright price surveys and intelligence gathering to price spreads - instantly making their numbers less time sensitive and more actionable.

Up to the CFOs

Shifting the resins pricing paradigm from its current problematic, absolute form to a fair, relative form (crude oil spreads) will require the involvement of CFOs or higher in respective processor's and supplier's organizations. Once the shift is made, however, purchase and sales managers' jobs will advance to capturing fair price spreads for their companies and managing the absolute price via the abundance of risk management tools available in crude oil. Then, finally, businesses in the plastics industry can effectively manage their bottom line like energy, agricultural, metals, and other commodity-price sensitive businesses do.

About the author: Tom Langan is a risk management and trading consultant dba WTL Trading. He provides two levels of risk management services to processors and suppliers to help control resins costs, secure and improve profit margins, and increase sales.

About the Author(s)

You May Also Like