Profitable Plastics: Hedging resin costs the smart way

Last time in Profitable Plastics, we discussed forward price curves as an important tool to predict future resins costs and the risks of those costs moving higher or lower.

September 25, 2012

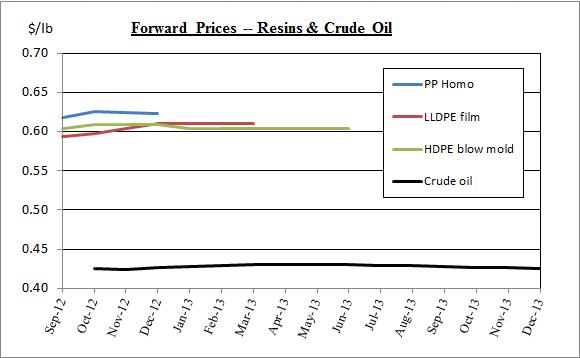

Last time in Profitable Plastics, we discussed forward price curves as an important tool to predict future resins costs and the risks of those costs moving higher or lower. Forward curves for HoPP, LLDPE film, and HDPE are provided on a daily basis by CME using PCW prices. As of 9-24-2012, the curves look like this:

Forward prics resins and crude oil

Why do I compare forward price curves for resins with the forward curve for crude oil? Here's why -

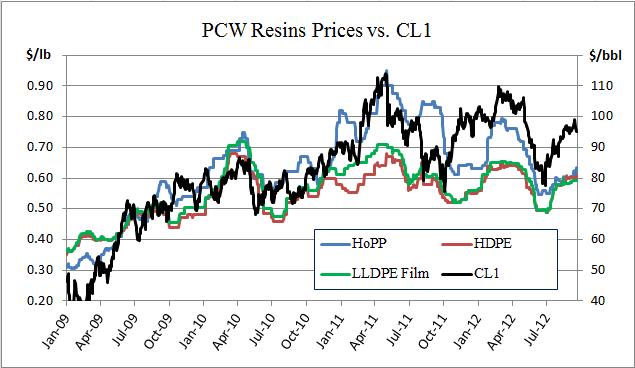

PCW Resins Prices vs. CL1

Over nearly four years, price correlations are 80-85% between daily resins prices and front-month crude oil futures. They're even higher (85-90%) in 2012.

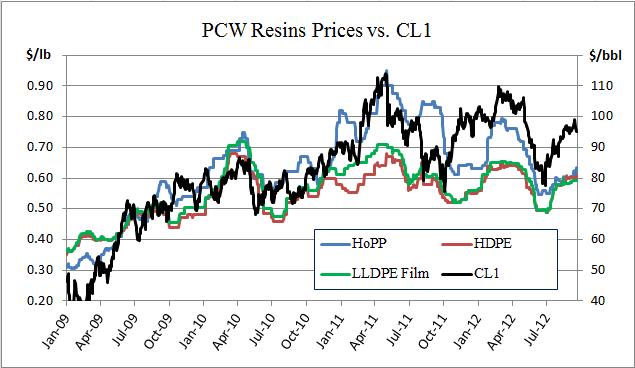

PCW Resins Prices vs. CL1

Given resins are petrochemicals, of course their pricing will be correlated with crude oil. But the fact that the correlations are so high, means forward resins prices will track forward crude oil prices; i.e. the shapes of the curves will be the same. At this time, flat.

The Good News

The good news for processors is there are two effective means to hedge forward resins costs: resins futures for polypropylene or polyethylene purchases or crude oil for most any resin purchases. Using crude oil as a hedge empowers processors to choose low cost/low risk hedging alternatives: options. Options are the "smart way" to manage price risk. They may be used to limit upside price risk before locking in resins purchases and/or limit downside price risk after locking in purchases. Options-based hedging programs save buyers and sellers angst and money - lots of both. That's why using them is smart.

Next time: crude oil markets and options hedging strategies

Later on: price differentials as "triggers"

About the author: Tom Langan is a risk management consultant dba WTL Trading. He helps processors and other manufacturers manage commodities costs, increase revenues, and secure profit margins. Email Tom at [email protected].

About the Author(s)

You May Also Like