Thermoforming’s gains help shape market

Once, processors either injection molded thin-walled packaging, or they thermoformed it, with the battle lines clear for all. But thermoforming’s advances have grabbed molders’ attention, so that molders’ expansion plans often now include adding thermoforming to their portfolio.

April 29, 2010

Once, processors either injection molded thin-walled packaging, or they thermoformed it, with the battle lines clear for all. But thermoforming’s advances have grabbed molders’ attention, so that molders’ expansion plans often now include adding thermoforming to their portfolio.

Many containers can be injection molded or thermoformed. Since the beginning of the plastics industry, the two methods have been largely practiced by completely separate companies. Injection molding machine builders have long been on the defense of their equipment with detailed studies, which always try to prove the better economics of their process. We extruder/thermoformers have never found such a defense necessary.

|

With the rapidly increasing price of commodity polymers, things have changed recently: Many of the major injection molders have entered into thermoforming by the acquisition of one or more companies in that business in order to remain a competitive supplier of containers, particularly to the dairy market.

The reason is simple: orientation strength, which is only obtainable by thermoforming because it is done below the melting point of the polymer, particularly with polypropylene. This produces cup-shaped containers such as those used for dairy products with much thinner walls but having the same compression strength as their injection molded equivalents.

Furthermore, injection machines used to have much larger capacities than thermoforming machines were capable of, and these also required a two-stage process: sheet extrusion followed by forming. Now most large-volume thermoformers are run directly inline with their sheet extruders, and capacities in the 6000-lb/hr range or even higher are available. These far exceed anything available in the equivalent molding range, and tilt the economics of large-volume thin-walled containers even more in that direction.

Nevertheless, the sheet extrusion/thermoforming process requires more skilled attention than injection molding, which can be turned on and off rapidly with little attention besides the correct settings of temperatures and cycle times. Sheet extrusion lines take several hours to preheat, and they require additional time to settle down once started up, plus some careful die and takeoff adjustments with which former injection molders must learn to live. While the transition has sometimes been painful, the results ultimately have been successful and have resulted in a large market conversion in that direction.

Machine time

Another large difference between the two methods is the market pricing of their machine time or return on investment. I see regular publication in the trade press of the current cost at which injection machine time is available on the market. Figures of far less than $100/hr come to mind for machines costing close to $1 million. No sheet extruder or thermoformer would ever sell at such low and simplistic prices. They think more in terms of $1000/hr return on a sheet line that costs well over $1 million plus the cost of the thermoforming machine operation. This is partially justified by the greater skill required by that process, but has resulted in some severe belt tightening in the industry, as well as some costly learning on the part of the novices.

While sheet extrusion and thermoforming were originally completely separate operations with cooled sheet in rolls fed to the thermoformers, most large-volume operations are now set up inline. The sheet line minus its winder directly feeds into the thermoformer with a short accumulator loop of sheet to compensate automatically for the difference between the continuously arriving sheet and the intermittent demand of the cyclic thermoforming machine.

Ideally, the sheet should be maintained hot enough for thermoforming without reheating for the best energy economy. This has been possible in some cases with short thermoforming machines, where the beginning and the end of each stroke are not too far apart.

Several European companies have been successful with this arrangement. My company also built many such systems to make millions of multicolor Solo Cups with large American-made thermoforming machines. A small three-roll stand was used to reduce the incoming sheet temperature from the over 4000-lb/hr capacity from the four-extruder system down to the lower thermoforming level, followed by a hot accumulator loop and some reheating to equalize the incoming and outgoing sheet temperatures. This worked quite well and efficiently for polystyrene, but was not sufficiently precise for the more critical temperature demands of the crystalline polypropylene.

Operating with polypropylene operations inline is preferred at any level of capacity because of the material’s very narrow temperature forming window. PP has a fairly sharp melting point in the 315°F (about 157°C) range. Because of the resulting orientation, it achieves its best properties of stiffness and clarity if it is formed just below its melting point. When the sheet is wound into rolls, it is never perfectly cooled to room temperature before winding. It takes several days of storage time to stabilize it both longitudinally and laterally. If used before total uniformity is attained, the product is variable and uncontrollable. Consequently, inline operation is an ideal solution because the sheet exiting the line is always at the same temperature. This can be as high as 180°F to conserve at least some of the energy contained in the sheet and to reduce its consumption.

Economics

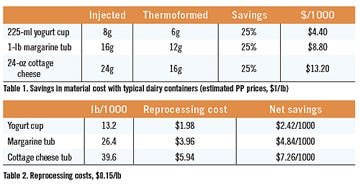

It is difficult to calculate or to justify the relative economics of the two processes because of their differences in scale. Thermoforming lines with capacities of 6000-8000 lb/hr are becoming the norm for high-volume items such as cups and for dairy containers. There is no injection molding machine in that range, so the investment/return costs are not calculable. On the other hand, a material cost savings of 20% or more because of the orientation stiffening of polypropylene in the thermoforming process makes all the difference in product cost and quality (see Table 1).

Admittedly, thermoforming probably consumes more overall energy than injection molding because of the approximately 50% scrap level that must be re-extruded. If we consider the three cases in Table 1 and apply an average reprocessing cost of $0.15/lb for reprocessing, net savings are still obtained (see Table 2).

While nobody in the U.S. has yet chosen to thermoform the lids for the larger containers in Table 2, several European manufacturers have done so. And while there is no significant orientation benefit, their thickness is easily cut in half without any disadvantage. That means that the lids are reduced, for example, from 6g to 3g in weight for a material cost savings of $6.60/1000, or 50%.

Furthermore, lids can also be melt formed on directly combined rotary wheel thermoforming machines, which fully conserve all of the extruder-generated energy and greatly reduce the equipment cost while increasing production capacity up to hundreds of thousands of lids per hour on one fairly simple continuous machine.

The indisputable material-saving economics will continue to increase the popularity of the sheet extrusion/thermoforming inline process in the future.

Frank Nissel is chairman of Welex Inc., a leading manufacturer of sheet extrusion lines. Nissel, a multilingual Renaissance man, has been a member of the Plastics Hall of Fame since 2000.

About the Author(s)

You May Also Like