Rise of the robots: China automates to maintain its global competitiveness

Chinese manufacturers are confronted with two critical manpower issues: A declining working-age population and skyrocketing wages.According to the International Labor Organization (ILO), the average monthly wage for a worker in China was $613 in 2013 (the most recent year for which data is available) compared with $391 in Thailand and $183 in Indonesia. Further, China's National Bureau of Statistics reported that the working-age population—defined as those between ages 16 and 59—fell by 371,000 in 2013 to about 915 million in 2014.

December 22, 2015

Chinese manufacturers are confronted with two critical manpower issues: A declining working-age population and skyrocketing wages.

According to the International Labor Organization (ILO), the average monthly wage for a worker in China was $613 in 2013 (the most recent year for which data is available) compared with $391 in Thailand and $183 in Indonesia. Further, China's National Bureau of Statistics reported that the working-age population—defined as those between ages 16 and 59—fell by 371,000 in 2013 to about 915 million in 2014.

To boot, steady economic growth in the central and western reaches of China means workers are more likely to find work at or close to home and are less likely to travel east as migrant workers.

To boot, steady economic growth in the central and western reaches of China means workers are more likely to find work at or close to home and are less likely to travel east as migrant workers.

Faced with the prospect of fewer, more expensive workers, it comes as no surprise that companies in the export-oriented province of Guangdong and elsewhere in China are rushing to automate, in particular their assembly processes. Take Gree Electric Appliances Inc. of Zhuhai, for example.

The world's largest specialized manufacturer of air conditioners, Gree reduced its headcount by 10,000 in 2014, to a total of 80,000, while simultaneously raising revenue from around $19.4 billion in 2013 to $22.6 billion. The company increased productivity through an automation program initiated in 2012 when it started to manufacture its own robots, automated guided vehicles (AGVs) and other automation equipment. Gree's showcase of automation is a plant in Guangdong, housing 150 injection presses connected to a centralized material feed system. Hot stamping is integrated press-side, while conveyors are used for part transfer. Further, AGVs are employed to transport tooling and inserts to the injection presses.

"Our automation needs are specialized on account of the wide variety of air conditioners we manufacture, but we found the technological level of Chinese robots insufficient," says Lewis Liu, Sales Manager, Industrial Goods - Automation at Gree. "Therefore, rather than import automation equipment, we decided to manufacture it ourselves." And as evidenced by Liu's title, Gree's robots and other automation solutions are now available to the plastics processing industry. The company commenced external sales in 2014.

Also in the appliance field, Midea plans to slash its air conditioner division workforce of 30,000 by 6,000 by the end of 2015 at its factory in Foshan, Guangdong Province, and a further 4,000 by 2018. Midea invested $145 million between 2011 and 2014 to install automation systems incorporating some 800 robots. It plans to spend a similar amount to add another 600 robots this year.

Joining Gree in expanding into the automation sector is Shenzhen Rapoo Technology, better known as a manufacturer of computer mouses and keyboards. The company's robotics division works as a systems integrator and has undertaken automation programs at its parent as well as other companies, including one manufacturing remote control units. Rapoo's demo plant is composed of two production lines: A traditional system of eight workers, who turn out around 2,000 wireless mouses per day, and an automated line with robots and two workers that produces more than 1,500 daily. Company spokesperson Deng Fengxia notes that the annual labor costs for 1,000 workers is around $9.7 million, but it costs just $4.8 million to purchase 100 robots (including other associated costs) that will continue operating for 10 years.

Perhaps the most ambitious automation project in China was announced by electronics manufacturer Foxconn in 2011. Back then, founder Terry Guo predicted that by 2014 Foxconn would have installed 1 million robots at its plants in China. The company fell well short of that goal. As of 2014, just over 10,000 robots had been installed on Foxconn assembly lines, and the company's plants were 40% to 70% automated. A report by the Industrial Relations Network, part of the ILO, quoted a Foxconn engineer as saying "most Apple products are still assembled by people because mechanical devices can scratch the products' alloy cases, but fingers do not."

|

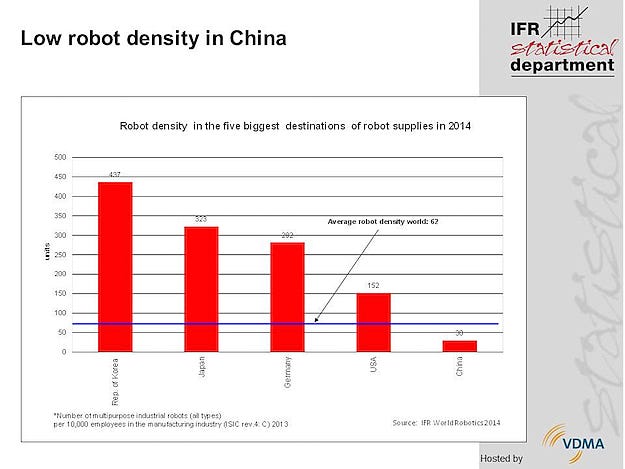

China's robot density remains substantially lower than the global average, despite its status as a manufacturing powerhouse. |

Another contract manufacturer was more successful in its automation efforts. Ever Win International, which is located at the manufacturing hub of Dongguan, installed 1,000 robots this year, joining 100 units that were already operating on its assembly lines, according to Chinese government mouthpiece, Global Times. Chen Qixing, Chairman of the company, was quoted as saying, "A robotic production line does not mean there is no human labor at all, but it will reduce the number of workers by about 90%. After the factory is fully equipped, it still will need a staff of about 200 [people] to control the network and serve as management; in the past, we needed more than 2,000 workers to operate the entire factory," he added.

Companies such as Ever Win International, Gree and Midea are receiving support from the Guangdong provincial government in their efforts to automate. The local authority's action plan will see around $152 billion invested in automation to promote application of robots in 1,950 companies in industries such as automotive, home appliances and electronics. The province also plans to build two advanced industrial bases for robot production by the end of 2017.

Preferential policies and subsidies that are part of the scheme will continue until the end of 2016, but even before they were offered, companies saw the need to automate. According to the municipal government in the city of Shenzhen bordering Hong Kong, productivity in 2014 rose 17%, while 6.8% of the labor force was shed.

Foreign robots capture more than 50% of market share

Multinational suppliers dominate the industrial robot sector in China despite the efforts of local players such as Gree and Rapoo. In fact four companies—ABB, Kuka, Yaskawa Electric and Fanuc—command a 58% share of the China market, according to Chinese consultancy Mir Industry.

Kuka and the two Japanese robot manufacturers already operate production plants in China. "China is by far the biggest robot market in the world in terms of annual sales; it is also the fastest growing market worldwide," notes a spokesperson from Kuka. "According to the International Federation of Robotics, the robot market is currently growing at an average annual rate between 10 and 15 percent. This is why it is important to manufacture locally in Asia and why we built our new production facility in Shanghai last year," the company adds. "In China, a very large number of processes are not yet automated. Better efficiency and quality are some reasons why Chinese companies are forced to automate in order to remain competitive." At present, the Shanghai facility manufactures the KR Quantec and the KR C4 universal controller. "However, we also study local market and customer requirements in order to be able to respond, if necessary," adds the spokesperson.

One newcomer to the robotics sector attracting attention is machine tool maker GSK CNC Equipment, China's largest manufacturer and designer of computerized numerical control (CNC) systems. The company also manufactures servomotors and drives, as well as all-electric injection molding machines. With its in-house capabilities in the motion control field, GSK says it is well placed to penetrate the industrial robot market, because it will not have to rely on costly overseas components. Several hundred units were reportedly shipped last year, with a target of more than double that in 2015. Longer term, GSK has aspirations of becoming a giant in the robotics field, with production in 2020 targeting 30,000 units. The company's target price, meanwhile, is 30% lower than imported robots, although it concedes that its technology may be less mature.

You May Also Like