Molders Economic Index: Spring flowers may bring blossoms of recovery

Recent economic data have been somewhat encouraging and this may carry with it the promise that a recovery will get started sooner rather than later. This May and June we anticipate a tangible increase in new orders to molders as well as an increase in capital equipment purchases.

April 21, 2009

Recent economic data have been somewhat encouraging and this may carry with it the promise that a recovery will get started sooner rather than later. This May and June we anticipate a tangible increase in new orders to molders as well as an increase in capital equipment purchases.

We may be somewhat alone with this optimist forecast. Note that we do not project high growth, but molders and across all sectors may anticipate growth in the 1.0-1.5% range annualized starting in June. Growth will start out small but pick up as the year progresses and as positive movement spreads from one sector to another.

Little of this growth is a result of stimulus packages from Washington or individual state governments. Most of the stimulus funds that have been released have gone toward stopgap measures, building capital reserves or loans to highly qualified borrowers rather than to those who need the most urgent help. A relatively small amount has hit the public in terms of tax refunds, but overall, the credit crunch continues and the bulk of the stimulus money for infrastructure, education, and the like has yet to be spent. Despite this, there is the widespread and, we believe, accurate perception that the economy is improving.

In April, Federal Reserve Bank of Minneapolis president Gary Stern said that while “appreciable strains” remain in credit markets, the resumption of U.S. economic growth “should not be too far off.”

With similar optimism, the World Bank in April noted that China’s stimulus plan may fuel the nation’s economic recovery this year, helping counter a global recession that is likely to drag growth in Asia’s developing countries to the weakest in 11 years. Developing East Asia, which excludes Japan, Hong Kong, Taiwan, South Korea, and Singapore, will expand 5.3% this year, less than a December estimate of 6.7%, the World Bank said.

Haitian International Holdings Ltd., China’s largest molding machine maker, also said in early April that “the worst” may be over and that the company may build significantly more than 15,000 injection machines in 2009. In 2008 it produced just 15,000 units, down from 19,000 units in 2007. While we have no way to verify these figures, the optimism is encouraging.

Possibly indicative of the growing optimism is that two major injection machinery vendors have now decided to exhibit at NPE2009 in Chicago after all. JSW Plastics Machinery Inc., which had dropped out early this year, reversed itself. KraussMaffei AG, a company that was on the fence regarding NPE, is now planning to attend the show. Previously Nissei Plastic Industrial Co. Ltd. also reversed a decision to stay away from Chicago.

In addition, we are seeing shipping lines scheduling the return of mothballed vessels to their fleets, an indication that they expect shipping to ramp up in the near future. News from the North Carolina Ports Authority that both Maersk Line and Independent Container Line have signed on as new customers support this positive trend.

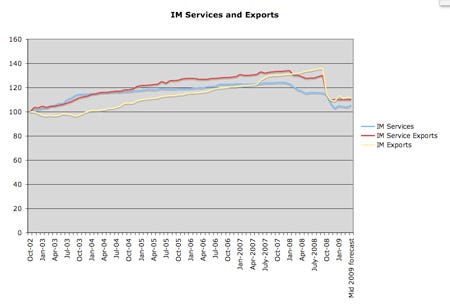

The U.S. trade deficit shrank by 28% in February, making it the lowest since November 1999. According to the U.S. Dept. of Commerce, the volume of goods exported rose 3.1% and imports fell by 5.3%, leaving February’s deficit at $26 billion. Considering that January’s deficit of $36.2 billion was considered good news, the February numbers are a clear win. There has been concern that printing too much U.S. currency could devalue the dollar in international markets, but a lower trade deficit helps to support the value of the dollar abroad. The trade deficit with Canada, America’s biggest trading partner, dropped to $1.82 billion in February, the lowest level since December 1998. The U.S. trade deficit with Japan fell to $2.2 billion in February. The U.S. still has the biggest gap with China even though it slid by 31% to $18.9 billion.

Sales down, unemployment up

News from the Institute of Supply Management (ISM) is not as positive. The Tempe, AZ-based firm’s manufacturing index indicated that economic activity failed to grow in March for a 14th consecutive month, and the overall economy shrunk for a sixth consecutive month. Although ISM’s manufacturing index registered 36.3 in March, up from 35.8 in February, a reading of less than 50 signals decline. The most encouraging shift manifested in new orders, as that indicator rose above the 40% mark for the first time in seven months. According to Norbert J. Ore, chairman of ISM’s Manufacturing Business Survey Committee, there is a bright spot in that “the rapid decline in manufacturing appears to have moderated somewhat.”

March retail sales dropped 1.1% after three months of positive movement. Severe storms hit most of the country, which accounted for some lost sales; however, the biggest drops were in car, electronics, and restaurant sales. Losses in these categories are traditionally based on economic perceptions, such as concern about losing a job. The only significant gains were in food and pharmacy, items that traditionally shoot up right before a major storm hits. Wholesale prices fell 1.2% in March following a gain of 0.1% in February.

The U.S. unemployment rate rose by 0.4% to a 25-year high of 8.5% in March as the U.S. economy lost an estimated 663,000 net jobs. Job losses in February were 651,000 in February and 741,000 in January. White House economic adviser Lawrence Summers, who served as a treasury secretary in the Clinton administration and was president of Harvard University, thinks the unemployment rate will get worse before it gets better. According to Summers, “Unemployment lags a little bit what happens to real economic activity. In order to keep the unemployment rate constant, gross domestic product (GDP) has to grow at a rate that economists argue all the time about, somewhere in the range of 2.5%; thus growth of 1.0% would see rising unemployment.”

Overall construction spending fell by 0.9% in February with higher declines in residential spending being offset by commercial construction. Pending home sales rose 2.1% in February despite a 3% drop in second home and investment home sales. According to the National Assn. of Realtors, the Pending Home Sales Index in the Northeast rose 10.6% to 63.9 in February but is 11.2% below a year ago. In the Midwest the index jumped 14.5% to 83.1 and is 3.4% higher than February 2008. The index in the South rose 4.4% to 85.8 in February but is 0.1% below a year ago. In the West the index fell 13.5% to 89.6 and is 1.7% below February 2008.

Auto and energy

U.S. automobile sales were still abysmal in March. Consumers are worried about the automakers imploding and it is hurting U.S. sales across the board. Automakers have been offering the types of deals that have traditionally boosted sales but have not been hitting the sales numbers they need to stay solvent. Ford is offering special discounts to those serving in the armed forces, to college students, to first-time buyers, and drivers over 62 years old in addition to local promotions that vary geographically. General Motors is offering qualified buyers 0% financing for up to 60 months plus an impressive “total confidence” package of coverage and services. Chrysler has its employee-pricing-plus program with lifetime zero-deductible power train warranty in full swing across the country. It has offered special discounts for military personnel and credit union members as well as run local incentives in different regions.

Toyota Motor Corp., which led the charge toward low financing and cash-back promotions, is tailoring offers to each geographic region. Some of the local incentives among the major automakers include payment protection in the event of a layoff, cash-back bonuses, and low financing. None of these efforts have paid off and U.S. auto sales are at a 27-year low. Comparing 2008 sales (which were terrible) to 2009, Ford posted a 40.9% drop in March U.S. sales while GM reported a 44.7% slide. Both Chrysler and Toyota saw March U.S. sales fall by 39.0%.

At the other end of the spectrum, China logged record auto sales in March. The China Assn. of Automobile Manufacturers (CAAM) reports that the country’s auto sales hit a monthly record of 1.11 million vehicles in March. It was the third month in a row that China’s monthly auto sales have exceeded those in the United States. China’s car sales were stimulated by tax cuts and rebates for small car purchases. China is expected to sell 10.2 million vehicles in 2009, up 8.7% year on year, said the CAAM.

As warmer weather approaches, energy prices are projected to continue to creep up. According to the Energy Information Administration (EIA), during this summer driving season (April through September) regular gasoline retail prices are projected to average $2.23/gal, down almost $1.60 from last summer. The average price of regular unleaded gasoline price for all of 2009 is expected to be $2.17/gal, increasing to an average of $2.42 in 2010. Diesel prices are projected to average about $2.27/gal during this driving season and to average $2.30 and $2.69/gal annually in 2009 and 2010, respectively.

In 2008 crude oil averaged $100/bbl. The EIA is projecting crude oil prices to average $53/bbl in 2009 and $63 in 2010 as the global economy rebounds. It also predicts that natural gas consumption will fall 2-7% and natural gas prices will decline from an average of $9.13/Mcf in 2008 to $4.24/Mcf in 2009, and then increase in 2010 to an average of more than $5.80/Mcf.

|

Agostino von Hassell ([email protected]) is president of The Repton Group and Lisa M. Pellegrino ([email protected]) is a senior advisor.

About the Author(s)

You May Also Like