Has PHA’s time come?

Scientists have known about polyhydroxyalkanoate (PHA) for a very long time. In fact, the simplest PHA, called P3HB, or sometimes just PHB, was discovered as early as 1926 by a French researcher, Maurice Lemoigne, in the course of his work with the bacterium Bacillus megaterium. At the time, little heed was paid to Lemoigne’s discovery, mainly because of its perceived irrelevance: at the time, fossil fuels were inexpensive and abundant.

August 3, 2015

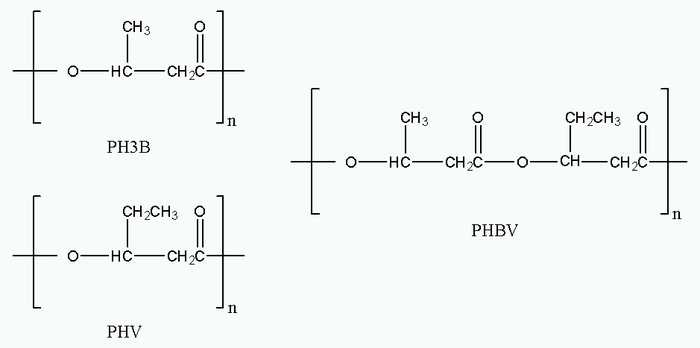

Scientists have known about polyhydroxyalkanoate (PHA) for a very long time. In fact, the simplest PHA, called P3HB, or sometimes just PHB, was discovered as early as 1926 by a French researcher, Maurice Lemoigne, in the course of his work with the bacterium Bacillus megaterium. At the time, little heed was paid to Lemoigne’s discovery, mainly because of its perceived irrelevance: at the time, fossil fuels were inexpensive and abundant. But all that started changing when, in the 1970s, the oil crisis started and bio chemicals and plastics started to become viewed as a viable alternative to petroleum-based materials. It was around that time that microbiologists brought PHA to the attention of the industry. So, what makes PHA so special? In the first place, PHA is not a single material, but a family of materials. PHA is nothing other than an energy storage material produced by different kinds of bacteria that can be harvested and processed into pellets. It’s the first polymer family to be produced by fermentation. Various PHA producing microorganisms have already been identified. Moreover, by changing the feed substrate of the microorganisms different types of PHA can be produced, which exhibit very different thermo-mechanical properties—from stiff and brittle to crystalline polymers to thermoplastic elastomers with low crystallinity and tensile strength with high elongation to break.

So, what makes PHA so special? In the first place, PHA is not a single material, but a family of materials. PHA is nothing other than an energy storage material produced by different kinds of bacteria that can be harvested and processed into pellets. It’s the first polymer family to be produced by fermentation. Various PHA producing microorganisms have already been identified. Moreover, by changing the feed substrate of the microorganisms different types of PHA can be produced, which exhibit very different thermo-mechanical properties—from stiff and brittle to crystalline polymers to thermoplastic elastomers with low crystallinity and tensile strength with high elongation to break.

Hence, PHAs have the potential to replace not just one, but a range of traditional plastics. For example, Newlight Technologies (Costa Mesa, CA), a major PHA producer, says its AirCarbon is able to meet the performance requirements of a wide range of applications, including applications currently using fossil fuel-based—HDPE, LDPE, LLDPE, PP, HIPS, ABS, acrylic, and TPU. It offers better performance than alternative bioplastics, such as PLA and starch, is fully biobased and biodegradable, some grades even in the marine environment.

Basically, this is why PHA has got so many people excited.

To date, however, PHA has failed to sparkle, performing more like a damp squib in the market. Extremely expensive to produce, its manufacturers have found it exceedingly difficult to find customers who willing to pay such a high price to be green. Moreover, performance problems were also reported. For a while, now, the market has been at a stage where there is high capacity but low consumption.

But things are changing and lately, PHA news has been coming in fast and thick. Bio-on, an Italian PHA producer announced it was building a new PHA production facility using Europe’s ubiquitous source of biowaste—the sugar beet —as raw material. Newlight Technologies, whose PHA is produced using advanced biological carbon capture technology, signed a 20-year master off-take agreement, under which it will sell 1 billion pounds of AirCarbon PHA. And industrial biotechnology company TerraVerdae BioWorks Inc., in Canada, announced that it successfully completed the scale-up optimization of its process to produce biodegradable PHA bioplastics from waste-derived methanol at commercial scale. MHG (Miami, FL), the former Meredian, has said it will be able to produce some six million pounds of biopolymer resin in 2015.

The difference is, these newer players in the PHA market are promising that their PHA is affordable, even competitive, in comparison to traditional polymers. They’ve invested in R&D to iron out performance problems and have developed less expensive production technologies. They’ve successfully manufactured PHA at scale—a prerequisite for an affordable product. Newlight Technologies, for example, developed a biocatalyst that generates a polymer conversion yield that is over nine times higher than before, enabling as the company has repeatedly said, its AirCarbon to out-compete oil-based plastics, such as polypropylene and polyethylene, on price.

Yet what also counts is the fact that it simply takes time for a new polymer to gain acceptance on the market. As Jan Ravenstijn, a Dutch biopolymers consultant with special expertise in PHA points out: “DSM’s Dyneema was patented in 1978, but only became profitable 20 years later. The same holds for Stanyl—a PA4,6, and Styron. Why should it be any different for PHA?”

Why indeed? Perhaps PHA’s time has finally come.

About the Author(s)

You May Also Like