Stretch and shrink film demand on the rise

Demand for stretch and shrink film in the U.S. is forecast to rise 3.3% yearly to $2.4 billion in 2015, according the latest study from The Freedonia Group, an industry market research firm. This increase will be driven by "accelerating demand for product packaging and for the bundling and protection of goods during warehousing and distribution, as well as competitive advantages over other packaging materials," said the study.

December 21, 2011

Demand for stretch and shrink film in the U.S. is forecast to rise 3.3% yearly to $2.4 billion in 2015, according the latest study from The Freedonia Group, an industry market research firm. This increase will be driven by "accelerating demand for product packaging and for the bundling and protection of goods during warehousing and distribution, as well as competitive advantages over other packaging materials," said the study.

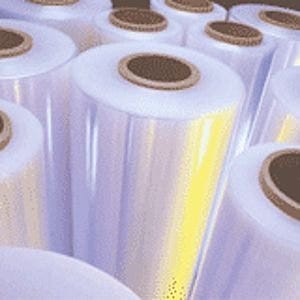

stretch film

Other drivers of stretch and shrink film will be resin and machinery improvement, and opportunities in areas such as stretch hoods and stretch labels and sleeves. Stretch film demand will increase 2.8% annually through 2015 to $1.4 billion, accounting for almost three-fifths of the total. The fastest growth is anticipated for stretch hoods due to their cost advantages, high throughput rates and excellent load integrity and weather protection.Demand for shrink film will grow 4.2% annually to $970 million in 2015, with advances being driven by shrink film's high clarity and excellent print capabilities, which enhances product marketability. In particular, growth will be helped by increased use in labels. Shrink film offers better seal and moisture barrier than stretch film, and is well-suited for covering heavy, non-uniform pallet loads, due to its higher puncture resistance and ability to help maintain load integrity, said The Freedonia Group's study.

Demand for stretch and shrink film resins is expected to rise 2.5% annually to 1.9 billion lb in 2015. Low density polyethylene (LDPE) is the leading stretch and shrink film resin due to its competitive cost and excellent elongation, puncture resistance and other properties, said the study. "Polyvinyl chloride (PVC) stretch and shrink film demand will remain flat through 2015 in volume terms, though value gains will be based on price increases. Shrink sleeve labels for foods and beverages will be the primary area of opportunity for PVC, with other areas declining as a result of PVC's poor environmental image and competition from LDPE films."

About the Author(s)

You May Also Like