Sponsored By

Automotive & Mobility

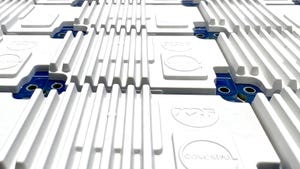

concept car seat made solely of PA 12

Automotive & Mobility

Evonik Debuts Single-material PA-12 Car Seat Concept at ChinaplasEvonik Debuts Single-material PA-12 Car Seat Concept at Chinaplas

PA 12 is used for the seat’s flexible foam, structural components, textiles, and 3D-printed parts.

Sign up for the PlasticsToday NewsFeed newsletter.