Sponsored By

News

Tesla Cybertruck

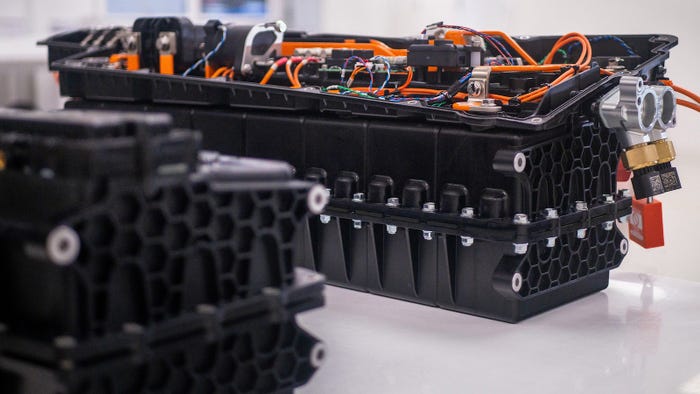

Automotive & Mobility

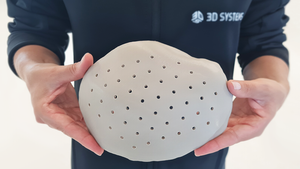

Tesla on Slippery Slope with Quick Fix for Accelerator PedalTesla on Slippery Slope with Quick Fix for Accelerator Pedal

The EV maker used soap as a lubricant to slip on tight-fitting pad.

Sign up for the PlasticsToday NewsFeed newsletter.